Introduction

Despite its business still experiencing macroeconomic headwinds, Alphabet’s (NASDAQ:GOOG) (NASDAQ:GOOGL) stock has rebounded by ~20.3% so far this year on the back of a “flight to safety” run into mega-cap tech stocks and incredible hype around artificial intelligence among institutional and retail investors.

While Google’s stock has marginally outperformed the Nasdaq-100 (QQQ) since the turn of the year, it is now the cheapest mega-cap tech stock based on a forward Price-to-earnings ratio. Also, Alphabet is trading well below its historical multiples.

Considering Alphabet’s long-running research and development leadership in artificial intelligence and the incremental progress it has made in this field over the last couple of decades, I think it is fair to wonder why Alphabet’s stock has not rallied like other artificial intelligence plays like Nvidia (NVDA) or Meta (META), which are up 88% and 78% year to date.

As of writing, Alphabet is sitting roughly ~29% off its all-time highs, and I think this historically deep pullback in GOOG stock could be a buying opportunity for investors.

In this note, we will evaluate Alphabet as a way to participate in the trending field of artificial intelligence whilst trying to understand the drivers of Alphabet’s relatively weaker stock performance. Furthermore, we will look at Google’s artificial intelligence opportunities to see if AI could enable a rebound in its stock.

Is Google an AI Stock? Does investing in GOOG increase exposure to AI?

Alphabet is a technology conglomerate that offers a wide range of products and services to consumers and businesses, including search engines, online advertising, cloud computing, consumer electronics, and productivity software applications. While Alphabet is not purely an AI business or stock, the company has been investing heavily in artificial intelligence (AI) for many years as an industry pioneer and has made significant progress in developing AI-powered products and services. For example, Google’s AI is used to power its search engine, its voice assistant, and its self-driving car technology.

In addition to in-house R&D, Alphabet has made several acquisitions in the AI space, and one such acquisition – DeepMind – is a world leader in AI research and has made significant advancements in areas like deep learning, reinforcement learning, and artificial general intelligence. Additionally, the company’s TensorFlow platform is a popular open-source machine-learning library used by researchers and developers worldwide.

Furthermore, Alphabet makes its own Tensor Processing Units [TPUs are custom-designed chips optimized for machine learning and artificial intelligence workloads] for Google’s data centers to power a variety of AI-powered products and services, including Google Search, Google Translate, and Google Photos.

While Alphabet’s business extends beyond AI, it is a major player in the AI industry, and investing in GOOG stock increases exposure to AI-related advancements and applications.

Why Is Google Not Going Into The Stratosphere On AI Hype?

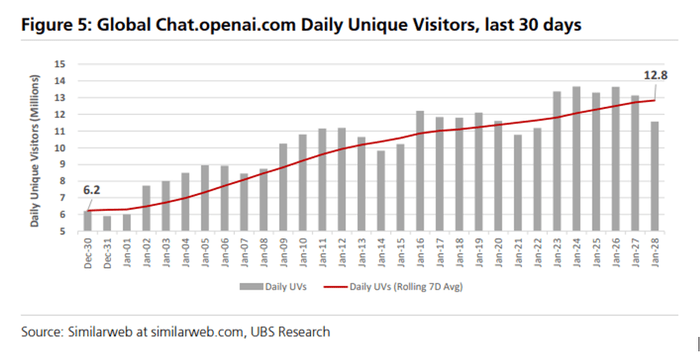

After being a buzzword in the technology sector for multiple decades, artificial intelligence [AI] is finally becoming mainstream and capturing the imagination of millions, with ChatGPT’s viral launch in late 2022 now being touted as the “iPhone moment” for AI. With incredible AI hype gripping Wall Street and Main Street investors alike, AI-related stocks have rallied higher in recent months. While Alphabet’s stock has done well in 2023, it has been a relative underperformer since ChatGPT’s launch on 30th November 2022.

While AI is undoubtedly the hottest term in the technology world right now, artificial intelligence has been in development for more than 70 years now, and Alphabet has been a leader in this space for the last ~25 years. Back in 2000, Google’s co-founder, Larry Page, laid out the following vision for Google:

Artificial intelligence would be the ultimate version of Google. So we have the ultimate search engine that would understand everything on the Web. It would understand exactly what you wanted, and it would give you the right thing. That’s obviously artificial intelligence, to be able to answer any question, basically, because almost everything is on the Web, right? We’re nowhere near doing that now. However, we can get incrementally closer to that, and that is basically what we work on. And that’s tremendously interesting from an intellectual standpoint.

In my view, this statement shows just how long Page and his counterparts at Alphabet have been thinking about artificial intelligence. A famous investing quote from Benjamin Graham reads –

In the short run, the market is a voting machine, but in the long run it is a weighing machine.

And as I see it, Mr. Market is voting against Alphabet’s stock for now due to OpenAI’s ChatGPT getting first-to-market in the generative AI space and its viral success so far.

ChatGPT has gained a lot of attention because it can have human-like conversations, generate creative writing, correct code, create plots and stories, and perform many other language-related tasks. In fact, ChatGPT has emerged as the fastest-growing software application of any type in history, amassing more than 100M users in less than 3 months.

According to UBS analysts –

In twenty years following the internet space, we cannot recall a faster ramp in a consumer internet app.

By comparison, it took TikTok about nine months after its global launch to reach 100M users and Instagram more than two years.

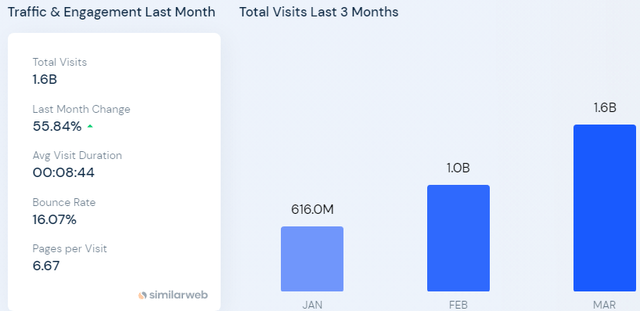

And according to figures from Similarweb, OpenAI’s ChatGPT has amassed 266 million total users since its launch in November last year, with visits continuing to grow at a rapid pace in recent months.

Over the last couple of decades, Google has come to dominate the internet search engine market [and, by extension, the digital advertising industry]. However, this search engine dominance is currently threatened by the explosive growth of revolutionary AI chatbots like OpenAI’s ChatGPT. And as we know, Microsoft is trying to utilize ChatGPT as a better mouse trap for Bing to win market share from Google in Search.

In response to ChatGPT (and other similar AI chatbots), Alphabet has launched its own AI chatbot – Bard; however, as we have discussed in the past, Alphabet finds itself in a lose-lose situation here due to potential cannibalization of its search engine business:

While I downgraded Alphabet from a “Strong Buy” to a modest “Buy” (and suggested DCA) in the note shared above, I have since been surprised to learn that Google’s global search engine market share ticked up to 93.37% in March 2023. Now, Alphabet’s business performance and stock are likely to remain under pressure in the near term due to added competition amid a challenging macroeconomic environment (contraction in digital advertising spend). Hence, I am not an aggressive buyer here. However, I do believe that artificial intelligence opportunities can lead to a rebound in Alphabet’s stock.

Now, let’s learn more about some of Alphabet’s AI opportunities.

Google’s AI Opportunities

Artificial intelligence is a complex and rapidly evolving field that’s projected to add $13T to the global economy by 2030, according to a report from McKinsey. While there is no guarantee that Alphabet will be successful in all of its AI initiatives, Alphabet looks well-positioned to emerge as a big winner in the era of AI. As we know, Alphabet has a strong track record of innovation and numerous advantages that could help it succeed in AI, including access to massive amounts of data (needed for training AI models), a world-class team of AI researchers and engineers, and a history of developing successful tech products and services that are used by billions of users on a daily basis.

In addition to the general AI opportunities in previous sections, Alphabet is also pursuing several specific AI initiatives that can potentially be major revenue streams in the future. These include:

Self-driving cars: Alphabet’s Waymo division is one of the leading developers of autonomous vehicle technology. While Waymo has been testing self-driving cars on public roads for several years, it has recently begun offering a limited self-driving car service in select cities like Phoenix [AZ]. If Waymo is successful, it could revolutionize the transportation industry and potentially create a new multi-billion dollar revenue stream for Alphabet.

Healthcare: Alphabet is investing heavily in healthcare AI, with the goal of developing new tools and services that can improve the quality and efficiency of healthcare. These initiatives include solutions like AI-powered medical diagnostics, personalized medicine, and virtual care. For example, Alphabet’s DeepMind AI has been used to develop new drugs and treatments for diseases like cancer and Alzheimer’s.

Retail: Google is also developing AI-powered tools for retailers, such as those that can help with inventory management, customer service, and fraud detection. These tools could help retailers improve their operations and increase sales. For example, Google’s AI is used to personalize product recommendations for shoppers on Google Shopping.

These are just a few of the AI opportunities that Alphabet is pursuing. Even if the company is successful in only one or two of these areas, it could generate significant revenue and help Alphabet’s stock rebound.

Concluding Thoughts

As artificial intelligence continues to evolve, Google looks well-positioned to benefit from new opportunities in this field. In my view, Alphabet has the resources, the expertise, and the track record to continue to develop successful AI-powered products and services. At TQI, we are currently sitting on the sidelines until GOOG returns to the $80s to add to our sizeable position in this stock due to concerns around valuation and the economy, I believe Alphabet remains a reasonably-priced stock to bet on AI.

Key Takeaway: I rate Alphabet a modest “Buy” at $104, with a strong preference for staggered accumulation.

If you are pondering between Alphabet’s tickers, here’s the better buy:

Thanks for reading, and happy investing. Please share your thoughts, concerns, and/or questions in the comments section below.

Are you looking to upgrade your investing operations?

Your investing journey is unique, and so are your investment goals and risk tolerance levels. This is precisely why we designed our investing group – “The Quantamental Investor” – to help you build a robust investing operation that can fulfill (and exceed) your long-term financial goals.

We have recently reduced our subscription prices to make our community more accessible. TQI’s annual membership now costs only $480 (or $50 per month) for a limited period only.

Post Disclaimer

The information provided in our posts or blogs are for educational and informative purposes only. We do not guarantee the accuracy, completeness or suitability of the information. We do not provide financial or investment advice. Readers should always seek professional advice before making any financial or investment decisions based on the information provided in our content. We will not be held responsible for any losses, damages or consequences that may arise from relying on the information provided in our content.