If you’re tired of being hit by costly exchange rates and account fees or want to move your operations to a more user-friendly platform, you might be in the market for a new business bank account.

If so, you’re in the right place because we’re reviewing one such option: Revolut Business.

But, if you don’t have time to digest my entire Revolut Business review, here are the headlines:

Overall, I think Revolut Business is a convenient digital banking provider; its selection of accounts caters to small and larger businesses alike, making it a good option for smaller brands looking for a business account that can grow as they scale.

That’s enough preamble; let’s walk through Revolut Business’s bells and whistles and answer your most important questions!

What Is Revolut Business?

Revolut Business is an umbrella term for the business bank accounts provided by the e-money institution, Revolut (who’s probably best known for its personal accounts).

Revolut is considered a bank in the EEA as it holds a full banking license in Lithuania. Since Revolut was founded in 2015, it now operates across 28 EU markets and boasts over 20 million users.

Revolut Business enables companies to sidestep the high fees associated with sending money abroad and manage team expenses directly from the app.

All sorts of businesses can open a Revolut account, including partnerships, sole traders, freelancers, and limited companies (both private and public). But unfortunately, Revolut doesn’t yet support foundations, charities, cooperatives, or public sector companies, but it aims to expand in the future.

Like many digital banking providers, you can set up your Revolut Business account entirely online. But please note your business needs to be registered in (and have a presence in) one of the following countries:

- Hungary

- Denmark

- Aland Islands

- Estonia

- Croatia

- Austria

- United Kingdom

- United States

- Romania

- Poland

- Portugal

- Jersey

- Malta

- Mayotte

- Slovakia

- Sweden

- Slovenia

- Spain

- Switzerland

- Latvia

- Lithuania

- Luxembourg

- Liechtenstein

- Finland

- France

- Germany

- Guernsey

- Greece

- Ireland

- Bulgaria

- Belgium

- The Republic of Cyprus

- The Czech Republic

- Italy

- Isle of Man

Suppose your business needs more than one account. In that case, you can open a multi-business account which allows you to open and manage multiple Revolut business accounts from the convenience of the Revolut app.

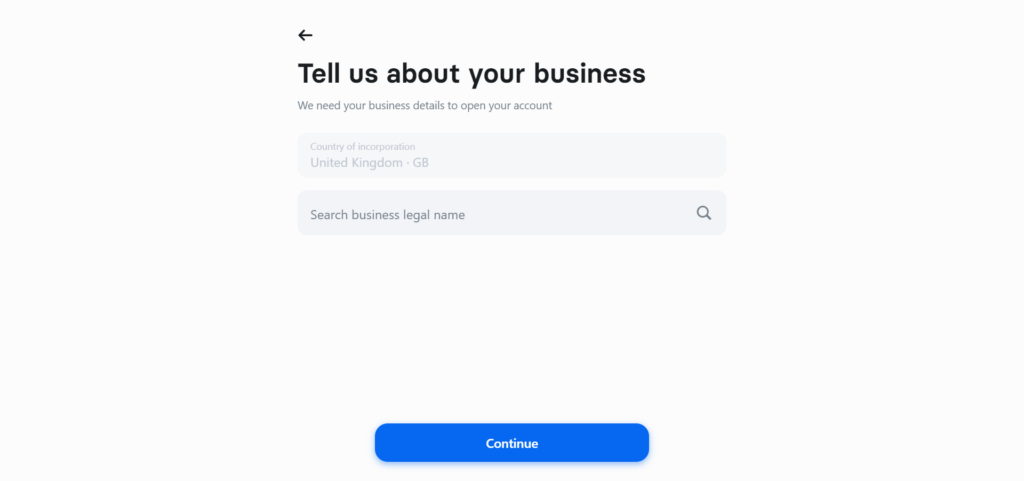

How To Open a Revolut Business Account

As I’ve just hinted, signing up for a Revolut Business only takes around ten minutes. You’ll fill out an online application that the Revolut team will then review, which takes between 1-7 working days.

You’ll need a few things to open your account, including:

- Photo ID and proof of your address

- Your business name, address, and incorporation details

- Details of the company’s shareholders and directors (anyone who owns more than 25% of the business). Shareholders and directors are also subject to an identity check.

Revolut Business Account Features

Now that we’ve covered the basics let’s dig deeper into Revolut Business’s core features:

Multiple Currencies

With a Revolut business account, you can exchange, receive, and hold money in more than 25 currencies, making it an excellent choice for businesses with international operations.

Businesses can also send international transfers in the following currencies:

- EUR

- GBP

- USD

- SGD

- SEK

- SAR

- TRY

- PLN

- RON

- ZAR

- AUD

- CAD

- BGN

- MXN

- HUF

- ILS

- NZD

- NOK

- JPY

- DKK

- CHF

- CZK

Revolut uses a variable business exchange rate. This means the exact rate isn’t set in stone. So, you’ll need to check with Revolut for the most up-to-date fee information.

That said, the pricing structure is always based on the same formula:

‘Fee + market rate = total cost’

You may also need to pay an additional percentage fee for certain currency conversions depending on when and how often you make a currency trade.

It’s also worth noting that you might be subject to higher fees if you’re trading currency during ‘off-market’ hours, which vary depending on where you’re located in the world.

For more information about Revolut’s currency exchange fees, head to the Business Fees section of Revolut’s website.

Cryptocurrency

With a Revolut Cryptocurrency Business Account, you can buy, sell, and hold Bitcoin and Ether quickly and efficiently without hidden fees.

It’s also worth highlighting that you can buy and sell Bitcoin and Ether in over 30 currencies, 24/7.

Conveniently, you can access your cryptocurrency portfolio anytime via the app and even set in-app alerts to notify you of your desired coin prices. Plus, you can access live and historic Bitcoin and Ether price data.

You can also choose to hold your Bitcoin in cold storage. When you place Bitcoin in cold storage, it’s held in a secure offline location, such as a hardware wallet, to protect your assets from hackers.

Virtual and Physical Debit Cards

When you set up a Revolut Business account, you’ll get virtual and physical plastic cards for your team.

You can order up to 200 virtual cards for your team members and a maximum of three plastic cards per team member – this applies to all plans.

Alternatively, if you upgrade to a paid plan, you can also order limited edition stainless steel cards.

You can order cards through the Revolut app and retain control over them. For example, you can set limits on each card, track payments, freeze and unfreeze cards, and decide where your team can use them. Staff will also receive automatic reminders for when to submit receipts for their expenses, making it easier to keep on top of bookkeeping.

Accountancy Software Integrations

You can connect your Revolut Business account with external accounting software such as Xero, QuickBooks, and more. This makes it easier to create invoices, view holistic real-time data concerning your business finances, oversee purchase orders and outstanding invoices, and more.

API Access

Note: API access isn’t available with the free Revolut Business Account.

With Revolut Business’s premium accounts, you’ll have API access. This enables you to create custom integrations for your existing tech stack.

Payroll

You can also manage payroll directly from your Revolut Business account.

You can add your employee’s payment details, make tax calculations, pay salaries, and run more complex tasks such as changing employee tax codes, all from the app.

Another significant benefit for employees is the ‘On-Demand Pay’ feature, which allows you to grant employees access to their salary as it’s earned rather than waiting until the end of the pay period. Of course, you can choose whether to activate this feature, so fear not; you retain complete control over your cash flow.

Team Permissions

You can assign your team one of four default roles:

- Admin: Unrestricted access to all the features in the Revolut Business app

- Accountant: Accountants can perform certain financial operations

- Member: A member can only view their own business card and account information via the app

- Viewer: A viewer has almost no permissions. They only have read-only access to the business app.

Customer Support

Revolut provides 24/7 customer support via its in-app chat and email. To access in-app chat, simply open the Revolut app, click on your profile icon, and select the ‘new chat’ option.

There’s also an automated phone line available 24/7. You can use this to block your card and access pre-recorded information to answer FAQs. However, you can’t directly speak to an advisor over the phone.

Revolut Business’s Pros and Cons

A software review isn’t worth its salt without a quick pro-cons list, so let’s sum up some of what we’ve discussed with a brief breakdown of Revolut’s Business’s perks and drawbacks:

Pros 👍

- Simple setup: The setup process is completed online – you just need to complete the appropriate forms and provide a copy of your ID (which shouldn’t take more than a few minutes). You can have your business account ready to go within seven days or sooner!

- Send and receive funds in multiple currencies: You can send and receive cash in several currencies.

- Manage your team’s cards: You can easily manage your team’s cards via the app. I.e., you can control when and where they spend cash, manage credit limits, and more.

- Responsive mobile app: You can manage all your finances from Revolut’s user-friendly mobile app.

Cons 👎

- No cash or cheque deposits: Revolut Business doesn’t accept cash or cheque deposits. If you need to deposit a cheque, you’ll need to contact the payer and ask them to transfer the funds directly into your business account.

- You may be charged for ATM withdrawals: With a Revolut Business account, withdrawing cash is free – up to the limits applied to your plan. Beyond these limits, you’re charged a fee of 2% on the value of your ATM withdrawal.

- No physical branches: This isn’t so much a drawback of Revolut, but rather online banks in general. So, suppose you’d prefer to speak to an advisor in-person about your banking queries. In that case, you don’t have this luxury with Revolut, as it’s completely digital.

Revolut for Business Pricing

Here’s how much you can expect to pay for Revolut’s business plans:

Free Account

You can get started with a Revolut company or freelancer account for free. This includes:

- Three plastic cards and up to 200 virtual company cards

- Five fee-free local payments

- A 1.99% crypto exchange fee

- Free transfers to Revolut accounts

- You can create and track invoices.

- You can accept payments on your website

- You can request payments via shareable links

- Team management options (inviting unlimited team members to the account and controlling team member permissions.)

- Access 24/7 customer support

- Spend in 150 different currencies

Business Grow Account (£25 monthly fee)

You’ll get all the features on the free plan, plus:

- Ten fee-free international payments

- 100 fee-free local payments

- A 0.99% crypto exchange fee

- You can send bulk payments

- API access

- Access to integrations like QuickBooks, Xero, and Slack.

Business Scale (£100 monthly fee)

You’ll get all the benefits of the above accounts, plus:

- 1,000 fee-free local payments

- Access to real-time financial analytics like spend analysis, spending breakdowns for specific accounts, and more.

Business Enterprise (Custom)

The Business Enterprise plan is designed for larger organizations. You’ll get all the features mentioned above, plus:

- A custom number of fee-free international payments and local payments

- Custom European consumer, international, and commercial cards

On top of these accounts, there are also two more options for freelancers:

- Professional

- Ultimate

Freelancer Professional (£7 monthly fee)

You’ll receive the following:

- Three plastic company cards per account owner

- Five fee-free international payments

- Bulk payments

- Free transfers to Revolut accounts

- You can create and track invoices

- You can accept payments on your website

- You can request payments via shareable links

- Access to team management options, such as permission setting and inviting unlimited team members

- Connect to apps such as QuickBooks, Slack, and Xero

Freelancer Ultimate (£25 monthly fee)

You’ll get all the perks of Freelancer Professional, plus:

- One metal card

- Virtual company cards

- Ten fee-free international payments

- 100 fee-free local payments

- Access to financial analytics via the app

Revolut Business Review: Is It Worth It?

That brings me to the end of my Revolut Business review; thanks for sticking with me.

All in all, I think Revolut Business is a trusted and scalable digital banking solution, making it a suitable choice for freelancers, SMBs, and larger corporations alike.

The app is exceptionally convenient, exchange rates are competitive, and I also like that a specified number of fee-free international payments are available (depending on your chosen account).

However, Revolut Business doesn’t offer features like credit or overdrafts. So if you need banking services like these, you’ll need to look elsewhere.

Revolut Business is free to get started, so what have you got to lose by giving it a try? That’s all from me; let me know how you get on in the comments box below!

Post Disclaimer

The information provided in our posts or blogs are for educational and informative purposes only. We do not guarantee the accuracy, completeness or suitability of the information. We do not provide financial or investment advice. Readers should always seek professional advice before making any financial or investment decisions based on the information provided in our content. We will not be held responsible for any losses, damages or consequences that may arise from relying on the information provided in our content.