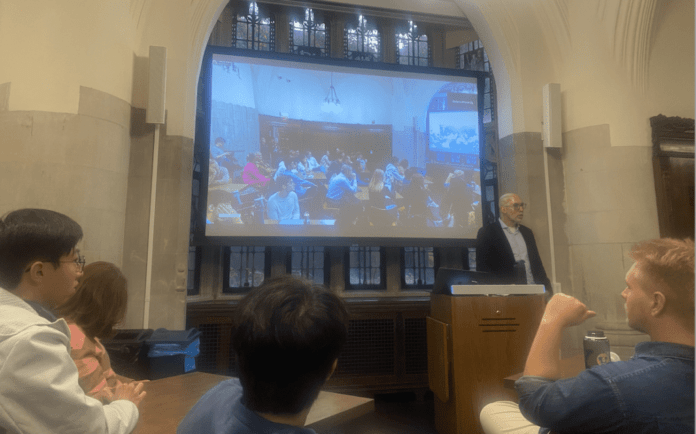

Peter S. Goodman, a global economics correspondent for the New York Times, delivered a talk sponsored by the Poynter Fellowship in Journalism on Monday.

1:40 am, Nov 08, 2023

Emily Aikens, Contributing Photographer

On Tuesday, the Humanities Quadrangle was packed with students, local community members and professors to hear Peter S. Goodman speak about the global economy’s recent changes in a talk titled “Is Globalization Ending? No, but It’s Changing.”

The Nov. 6 event was sponsored by the Poynter Fellowship in Journalism, a program that Nelson Poynter established in 1976 “to bring distinguished journalists who have made significant contributions to their fields to Yale,” according to the University’s Office of Public Affairs and Communications. Other recent guests hosted by the fellowship have included award-winning director Camilla Hall and former Obama speechwriter David Litt ’08.

Brunella Tipismana ’26 attended the event and said she went because she is interested in journalism and to hear from Goodman given his expertise in global economics.

“I am a history student, but I’m interested in economic journalism and, more generally, the supply chain breakdown of 2020,” she said.

Before becoming a global economics correspondent for the New York Times, Goodman worked as a national economics correspondent for the Times. In this role, he contributed to a series of articles covering the Great Recession, which was a finalist for the Pulitzer Prize. He is also the author of two books — “Past Due: The End of Easy Money and the Renewal of the American Economy,” a 2009 publication that analyzes the origins of the Great Recession, and “Davos Man: How the Billionaires Devoured the World,” a 2022 text about economic inequality’s relationship to democratic governance.

Although Poynter’s events are advertised to students interested in journalism, the event also attracted students interested in politics.

Alexander Harasimowicz ’25, a political science major, attended the talk with other students in a graduate seminar, “Justice, Taxes, and Global Financial Integrity”

Attending the lecture was a requirement for the class, Harasimowicz said.

During his 45-minute presentation, Goodman said that the world is entering a new era of globalization — one that will move away from reliance on foreign factory production.

“What I’ve learned is that our previous form of globalization — the kind where we depended on production in China, container shipping and underpaid workers — has finally collapsed,” Goodman said. “It’s an open question of what is going to replace it.”

After introducing this premise, Goodman spoke about the United States’ involvement in globalization, how it came undone and what people can expect next.

By not relying on foreign suppliers, Ford ensured that his company could remain self-sufficient, Goodman said. However, the 1919 case Dodge v. Ford Motor Company held that Ford’s company had to operate in the interests of its shareholders instead of prioritizing the interests of its employees and customers. This decision, Goodman said, meant that Ford began outsourcing production, particularly relying on Chinese vendors for the F150’s computer chip.

“Their entire productive capacity now hinged on this requirement to get a component that is being made on the other side of the Pacific Ocean.,” Goodman said.“That would have horrified Ford.”

Although Goodman said that American businesses have increasingly moved towards globalized production, especially since China joined the World Trade Organization in 2001, he added that this relationship has recently fallen apart.

He said this change is not the end of the United States’ relationship with China but that it is a “new phase” with the trading partner and the United States’ reliance on factories in other countries.

Goodman attributed this change to recent supply chain issues, illuminated by the pandemic.

“Relying on far-away factories is full of perils. The geopolitics have changed such that relying on Chinese factories is tricky,” Goodman said. “The pandemic exposed the dangers of this mode, of pretending that there was no shock that would lie ahead of us.”

But, Goodman asked, if the American relationship with China is unraveling, what is next for American businesses?

Goodman proposed two possibilities: reshoring or nearshoring, both of which American businesses currently engage in. While reshoring involves moving international production back to domestic factories, nearshoring shifts production to bordering countries such as Mexico.

Concluding the talk, Goodman emphasized the potential economic benefits of trading with and moving production to Mexico for American businesses.

With the United States’ move to nearshoring in Mexico, as of July, Mexico took China’s previous role as the United States’ biggest trading partner, Goodman said.

Although he said that he is in favor of decreasing trade with China, Goodman emphasized the importance of not abandoning trade with the country altogether.

“We should not celebrate stepping back from trade,” he said. “If it wasn’t for trade, none of us would be in this room right now talking about the future of globalization. While trade has become a loaded word in political discourse, it is a net positive for most economies.”

Students lingered after Goodman’s presentation to ask questions and discuss the lecture with their peers.

Goodman’s upcoming book “How the World Ran Out of Everything” will further delve into the implications of modern globalization and will be published in 2024.

Post Disclaimer

The information provided in our posts or blogs are for educational and informative purposes only. We do not guarantee the accuracy, completeness or suitability of the information. We do not provide financial or investment advice. Readers should always seek professional advice before making any financial or investment decisions based on the information provided in our content. We will not be held responsible for any losses, damages or consequences that may arise from relying on the information provided in our content.