We had a jam-packed week filled with earnings both in and out of the Action Alerts PLUS portfolio, as well as the latest Fed policy meeting that, as expected, saw the central bank lift the Fed Funds rate another quarter-percentage point. We also received the initial print for second-quarter gross domestic product that came in stronger than expected at 2.4% relative to consensus expectations, but also compared to the final 2.0% figure for the first quarter. This, along with further progress on inflation and evidence of real growth, tweaked the growing market narrative for the U.S. economy from a soft landing to a Goldilocks one.

For those unfamiliar with the term, it’s lifted from the popular children’s story Goldilocks and the Three Bears. A “Goldilocks economy” describes an ideal state for an economy where it is warm enough with steady economic growth to prevent a recession; however, growth is not so hot that it pushes up inflation. Also, the June-ending quarter earnings season, in aggregate, has been better than expected. So far about half of the S&P 500 has reported, with 80% of those companies reporting a positive earnings per share surprise and 64% a positive revenue surprise per data tabulated by FactSet.

A few weeks ago, we said that with the S&P 500 trading at more than 20-times expected 2023 EPS, earnings expectation for the second half of 2023 and 2024 would be key to driving the stock market demonstratively higher. Based on the latest revisions, those expectations are marginally lower than where they were a few weeks ago. With the S&P 500 marching higher over the last three weeks, it faces resistance at 4,600 as it once again flirts with being overbought. We are also entering what tends to be a seasonally weak time of year for the market, once that coincides with thinner trading volumes as folks squeeze in the part of summer vacation before schools are back in session.

As we enter that period, we will tread carefully and prudently with the AAP portfolio, looking for opportunities to position the portfolio for the coming months and quarters, carefully looking to avoid potential pitfalls as we do so.

Catching Up on the AAP Portfolio This Week

Reviewing the portfolio’s performance for July reveals outsized gains our shares of Applied Materials, American Water Works, Bank of America, Costco, Deere. & Co., Alphabet, Marvell, Trinity Capital, and the Energy Select Sector SPDR Fund. Offsetting those gains was the move lower in Axon shares, which we finally used this week to pick up additional shares. Coty shares were also a drag on the portfolio in so far in July as were our ProShares Short QQQ ETF shares. Similar to our move in Axon this week, last week we grabbed some additional shares in Coty as well. In addition to picking up some AXON shares this week, we also expanded the portfolio’s exposure to Applied Materials, funding those buys by trimming back our exposure to Cboe Global Markets.

We also closed out the portfolio’s position in Ford Motor following the tentative agreement reached between the Teamsters and UPS. That sets the stage for rising costs at Ford as it, along with General Motors and Stellantis, negotiate with the United Auto Workers. Following comments from Tesla CEO Elon Musk he would continue to cut EV prices, setting a challenging environment for Ford and others, that Teamster-UPS announcement was the proverbial straw to break our back on F shares. When Ford reported its quarterly result this week, it pushed back its EV production target and estimated it would now see a loss of about $4.5 billion for the year on the Ford Model e, “reflecting the pricing environment, disciplined investments in new products and capacity, and other costs.” During the first half of 2023, Ford’s Model e business posted a $1.8 billion earnings before interest and tax loss.

As we prepare to enter August, we are mindful we are entering a seasonally weak time of year for the market. We will continue to look for opportunities to increase our exposure to the shares of Applied Materials, Universal Display, and few other existing positions. We will also keep close watch on the shares of Morgan Stanley, McDonald’s, and Qualcomm in the Bullpen. As it relates to Bullpen resident Kellogg, a potential catalyst for calling the shares up to the portfolio will be its Aug. 9 event at which more information on WK Kellogg and Kellanova will be shared.

This Week’s AAP Videos and Podcasts

We cover a lot of ground during the week in our Daily Rundowns and the AAP Podcast. If you happened to miss one or more of them, here are some helpful links:

Monday, July 24: Why We’ve Soured on Ford and What to Expect From Earnings This Week

Tuesday, July 25: Here’s Our Game Plan for the Fed and These Portfolio Stocks

Wednesday, July 26: Comparing Microsoft and Alphabet Earnings and Your Top Questions Answered

Wednesday, July 26: Here’s the Real Question for the Fed Now

Thursday, July 27: Here’s How We’re Playing Chipotle After Earnings

Friday, July 28: These Bullpen Names Are Contenders for a Call Up

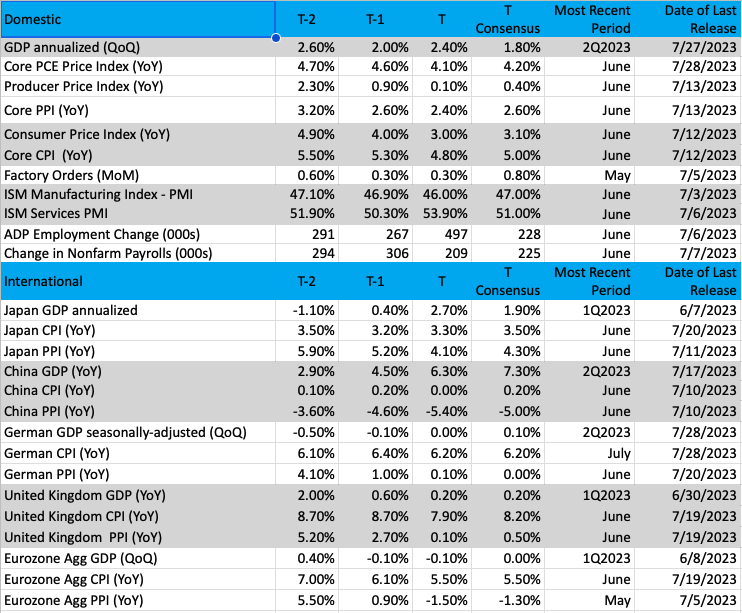

Key Global Economic Readings

(Note: T is the most recent period, T-1 is the prior period’s reading and T-2 is two periods back, the intent being to illustrate any trends)

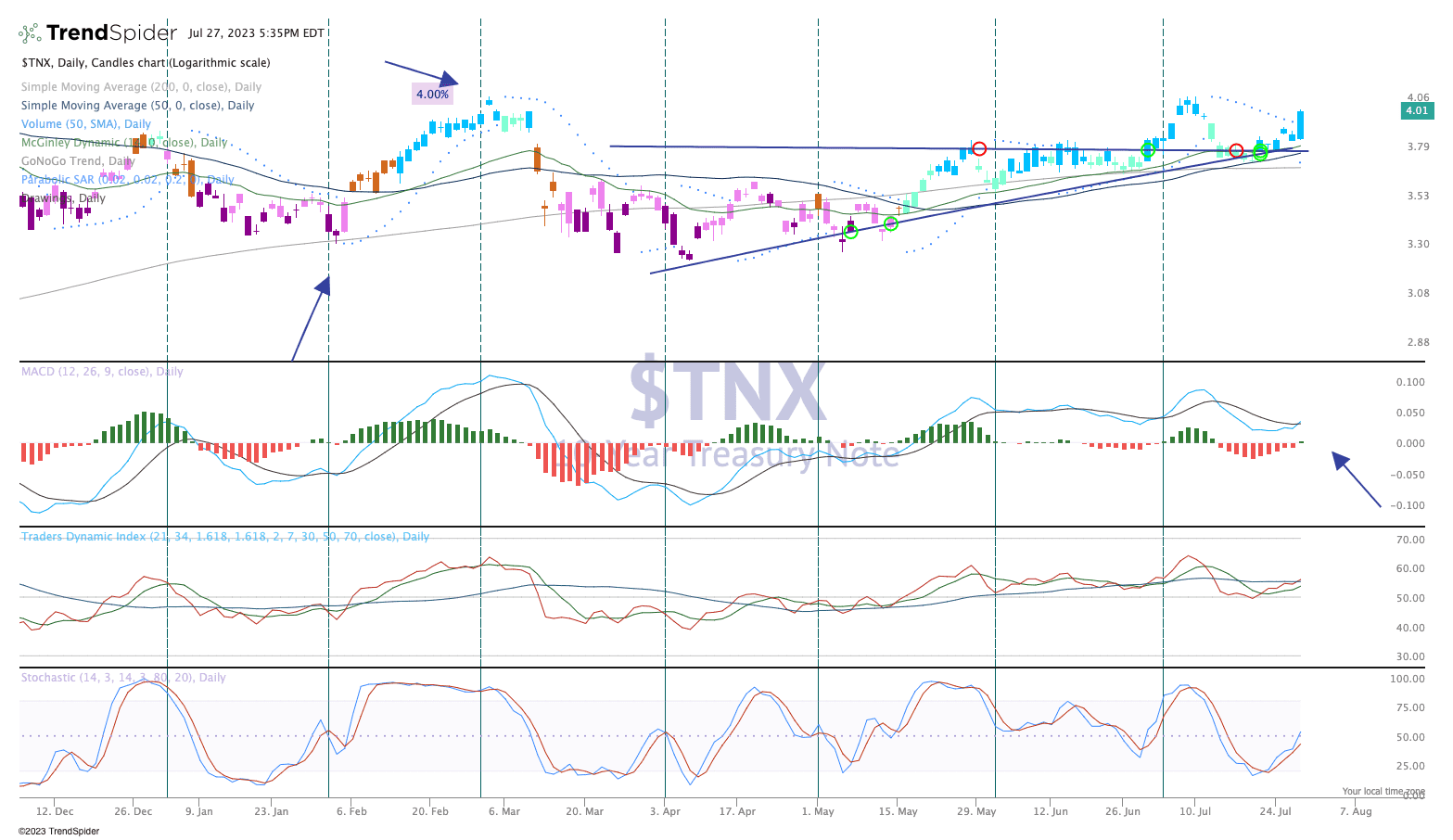

Chart of the Week: Quite the Big Move Up in Bond Yields

Yesterday’s surge in yield brought the markets down sharply for the first time in several days. It was a stark reminder that higher rates are fertile ground for profit taking in equities. It was a strange session as we saw the long bond shown here pushing up towards the 4% mark, which as you might remember the last time, we rose above 4% in early July there was a nasty stock selloff. Yet, that did not last for very long and yields started falling again, the risk-on asset managers/traders said, “game on” and started buying stocks again. But this last week yields have risen slowly towards the 3.75% level on the 10-year bond and then Thursday happened with a huge bolt higher as yields finished on their highs of the session. Without some news to counter this move, we often see some follow-through, and if the early March top is breached (see arrow in top pane), then investors will have to suddenly re-think their equity strategy.

The Moving Average Convergence Divergence (MACD) oscillator, which show changes in trajectory of moving averages before they occur is on a nice crossover move and is bullish (arrow, pane 2). Stochastics at the bottom are on the move, pushing towards the midpoint and possible an overbought condition before too long. Parabolic Stop and Reversal System pattern moved to bullish on Thursday, this indicator shows changes in trajectory of the price before they occur. These are the dots in the top pane, and we often see a string of these when they change direction. Bullish on yield, bearish on bonds. Finally, the triangle drawn was broken to the upside. This was a long narrowing of the range and there is likely to be plenty of time spent above that triangle, which means “higher for longer” as interpreted by the bond market.

For a more detailed chart here.

Other charts we shared with you this week were:

Monday, July 24: S&P 500 – Bull Mode Remains Intact as It Approaches Resistance

Monday, July 24: Applied Materials (AMAT) – This Stock Has Pulled Back to a Support Area

Tuesday, July 25: Axon Enterprises (AXON) – This Portfolio Name Has Entered the Buy Zone

Wednesday, July 26: Elevance Health (ELV) – This Portfolio Name Shows Breakout Potential

Thursday, July 27: Energy Select Sector SPDR Fund (XLE) – Crude Is Bubbling Up, and So Is This ETF

The Coming Week

With one trading day left in July, next week brings the start of August and it will bring with it the usual start of the month data as well as continue the onslaught better known as the June quarter earnings season. With the preliminary reading of +2.4% for the second quarter of 2023, the focus will now shift to determining how quickly the domestic economy as well as those for other key economies across the globe are growing in the current one.

Initial views on that will be shaped by what the July PMI data from S&P Global and the Institute for Supply Management say about the manufacturing and services sectors. As you’ve become accustomed to us saying, we will also be looking for indications for how the economy is poised to perform in August via the July new order data. We will also be assessing comments in the July PMI data pertaining to inflation, both input as well as output prices. We’ll be looking for signs for further inflation improvement ahead of the July Consumer Price Index and Producer Price Index out the week of August 7.

Next week’s economic calendar also brings the June Construction Spending Report, one we will be reviewing for our holdings in United Rentals, Vulcan Materials and to a lesser extend Deere & Co. The docket also brings fresh insights into the pace of job creation and wage data courtesy of the July Employment Report and ADP’s Employment Change Report for July.

Once we have all of the above data in hand, we’ll revisit the Atlanta Fed’s GDP Now model, which as we head into the weekend has an initial estimate of +3.5%. We would caution members we will only be starting to receive data for 3Q 2023 next week, and that initial reading from the Atlanta Fed should be taken with a grain of salt.

Here’s a closer look at the economic data coming at us next week:

U.S.

Monday, July 31

- Chicago PMI – July (8:30 AM ET)

Tuesday, August 1

- S&P Global Manufacturing PMI – July (9:45 AM ET)

- ISM Manufacturing Index – July (10:00 AM ET)

- Construction Spending – June (10:00 AM ET)

- JOLTS Job Openings Report – June (10:00 AM ET)

Wednesday, August 2

- Weekly MBA Mortgage Applications (7:00 AM ET)

- ADP Employment Change Report – July (8:15 AM ET)

- Weekly EIA Crude Oil Inventories (10:30 AM ET)

Thursday, August 3

- Productivity & Unit Labor Costs – 2Q 2022 (8:30 AM ET)

- Weekly Initial & Continuing Jobless Claims (8:30 AM ET)

- S&P Global Services PMI – July (9:45 AM ET)

- ISM Non-Manufacturing s Index – July (10:00 AM ET)

- Factory Orders – June (10:00 AM ET)

- Weekly EIA Natural Gas Inventories (10:30 AM ET)

Friday, August 4

- Employment Report – July (8:30 AM ET)

International

Monday, July 31

- Japan: Household Confidence -July

- Germany: Retail Sales – June

- UK: Bank of England Consumer Credit – June

- Eurozone: Consumer Price Index – July

- Eurozone: 2Q 2022 GDP

Tuesday, August 1

- Japan: Manufacturing PMI – July

- China: Caixin Manufacturing PMI – July

- Eurozone: Manufacturing PMI – July

- Eurozone: Unemployment Rate – June

- UK: Manufacturing PMI – July

Thursday, August 3

- Japan: Services PMI – July

- China: Caixin Services PMI – July

- Eurozone: Services PMI – July

- UK: Services PMI – July

Friday, August 4

- Germany: Factory Orders – June

- Eurozone: Retail Sales – June

Above we noted the earnings onslaught will continue next week. Given the more than 50% week over week increase in the number of companies reporting to more than more than 1,620, it will do more than just continue next week. Paired with the economic calendar shared above, it will be a barn burner of a week.

From a portfolio perspective, we will have quarterly results from Clear Secure (YOU), Vulcan Materials (VMC), Amazon (AMZN), Apple (AAPL), and Cboe Global Markets (CBOE). Outside the portfolio, quarterly results from Blink Charging (BLNK) and EVgo (EVGO) will give us insight into upcoming results from ChargePoint (CHPT). The same can be said for Coty (COTY) given earnings next week from elf Beauty (ELF). Ahead of Apple’s earnings, comments on the smartphone market from Qorvo (QRVO) and Bullpen resident Qualcomm (QCOM) will set the table for what the iPhone maker is likely to say. And comments about federal, state, and local public safety spending from Motorola Solutions (MSI) may be the catalyst to reignite our shares of Axon Enterprises (AXON).

Here’s a closer look at the earnings reports coming that we will be paying attention to for both the active portfolio and the Bullpen.

Monday, July 31

- Open: CNA Financial (CNA), Heartland Express (HTLD), On Semiconductor (ON

- Close: Avis Budget (CAR), Blink Charging (BLNK), Harmonic (HLIT), Monolithic Power (MPWR), Rambus (RMBS), Trex (TREX), Yum China (YUMC)

Tuesday, August 1

- Open: Altria (MO), Caterpillar (CAT), Eaton (ETN), Illinois Tool (ITW), JetBlue Airways (JBLU), Kennametal (KMT), Marriott (MAR), Molson Coors (TAP), Rockwell Automation (ROK), Sysco (SYY), Uber (UBER)

- Close: Advanced Micro (AMD), Caesars Entertainment (CZR), Denny’s (DEN), elf Beauty (ELF), Electronic Arts (EA), Mosaic (MOS), Pinterest (PINS), Starbucks (SBUX), Terex (TEX), VF Corp. (VFC).

Wednesday, August 2

- Open: Builders FirstSource (BLDR), Clear Secure (YOU), CVS Health (CVS), DuPont (DD), Emerson (EMR), Ferrari (RACE), Kraft Heinz (KHC), Radware (RDWR), Yum! Brands (YUM).

- Close: Bandwidth (BAND), CF Industries (CF), Cheesecake Factory (CAKE), DoorDash (DASH), Equinix (EQIX), EVgo (EVGO), Fastly (FSLY), MGM Resorts (MGM), PayPal (PYPL), Qorvo (QRVO), Qualcomm (QCOM), Shopify (SHOP), Zillow (ZG)

Thursday, August 3

- Open: Anheuser-Busch InBev (BUD), Canada Goose (GOOS), Cummins (CMI), Edgewell Personal Care (EPC), Hasbro (HAS), InterDigital (IDCC), Kellogg (K), Papa John’s (PZZA), Physicians Realty Trust (DOC), Portillo’s (PTLO), Shake Shack (SHAK), Vulcan Materials (VMC)

- Close: Amazon (AMZN), Apple (AAPL), Block (SQ), Cloudflare (NET), Dropbox (DBX), Fortinet (FTNT), Motorola Solutions (MSI), Post (POST), Synaptics (SYNA), WW (WW).

Friday, August 4

- Open: AMC Networks (AMCX), Cboe Global Markets (CBOE), GrafTech International (EAF), Protolabs (PRLB).

Positions:

ONEs

WEEKLY UPDATE: After sitting on the sidelines in recent weeks, we picked up some additional AXON shares this week as federal, state, and local government funding for public safety ramps in 2H 2023. The next known catalyst for our Axon shares will be when competitor Motorola Solutions reports its quarterly results next week.

1-Wk. Price Change: 1.5% Yield: 0.00%

INVESTMENT THESIS: Axon Enterprise Inc develops, manufactures, and sells conducted energy devices and cloud-based digital evidence management software designed for use by law enforcement, corrections, military forces, private security personnel, and private individuals for personal defense. The company operates in two segments: Taser and Software & Sensors. Taser develops and sells CEDs used for protecting users and virtual reality training. Software & Sensors manufactures fully integrated hardware and cloud-based software solutions such as body cameras, automated license plate reading, and digital evidence management systems. Axon delivers its products worldwide and gets most of its revenue from the United States. President Biden’s fiscal year 2023 budget requests a fully paid-for new investment of approximately $35 billion to support law enforcement and crime prevention — in addition to the President’s $2 billion discretionary request for these same programs. According to Mordor Intelligence, the wearable, and body-worn cameras market on its own was valued at $1.62 billion in 2020 and is expected to reach $424.63 billion by 2026.

Target Price: Reiterate $255; Rating: One

RISKS: Manufacturing and supply chain, competitive factors, government regulation, technology change.

ACTIONS, ANALYSIS & MORE: Strong Demand Bodes Well for This Conducted Energy Devices Firm, Initiating a New Position in a Public Safety Technology Name, Investor Relations.

WEEKLY UPDATE: This big bank really hit its stride this week, rising up sharply Monday on some pretty strong turnover. BAC was flirting with the 200-day moving average the prior week but pushed through that resistance with ease and now looks to meet that stiff resistance at the $34 level. News on Thursday that banks needed to maintain higher levels of capital may reduce the amount of excess capital BAC and other large banks have on hand for share buybacks and dividends. The rate hike from the Fed this past week may be a positive for BAC and their net interest margin (NIM), which is the excess income between bank loans and investment. This differential may rise with a higher interest rate.

1-Wk. Price Change: -0.3% Yield: 3%

INVESTMENT THESIS: Bank of America is one of the world’s leading financial institutions, serving individual consumers, small and middle-market businesses, and large corporations with a full range of banking, investing, asset management and other financial and risk management products and services. The company provides unmatched convenience in the United States, serving approximately 67 million consumer and small business clients with approximately 3,900 retail financial centers, approximately 16,000 ATMs and award-winning digital banking with approximately 56 million verified digital users. Bank of America is a global leader in wealth management, corporate and investment banking, and trading across a broad range of asset classes, serving corporations, governments, institutions, and individuals around the world. Bank of America offers industry-leading support to approximately 3 million small business households through a suite of innovative, easy-to-use online products and services. The company serves clients through operations across the United States, its territories and approximately 35 countries. From a reporting basis, the company’s business breaks down as follows: Net Interest Income breakdown: Consumer Banking 57%, Global Banking 23%, Global Wealth & Investment Management 14%, and Global Markets 6%; Income Before Tax breakdown: Consumer Banking 42%, Global Banking 27%, Global Wealth & Investment Management 16%, and Global Markets 15%. Bank of America pays a quarterly dividend of $0.22 per share.

Target Price: $37; Rating: One

RISKS: Financial markets, fiscal, monetary, and regulatory policies, economic conditions, and credit ratings.

ACTIONS, ANALYSIS & MORE: We’re Upgrading and Building Upon a Position, We’re Initiating a Bank Position, Investor Relations

WEEKLY UPDATE: B.Riley Securities reiterated its “Buy” rating on CHPT shares. Midweek, we discussed reports indicating BMW Group, GM, Honda, Hyundai, Kia, Mercedes-Benz Group, Stellantis NV — are teaming up for a yet to be named EV charging joint venture. This new joint venture is reportedly planning on adding at least 30,000 new chargers. The National Renewable Energy Laboratory estimates that 182,000 DC fast chargers will be needed in the US alone to support the 30-42 million EVs estimated on roads by 2030. This speaks to the rising tide lifts all boats we’ve discussed when it comes to the EV charging market, and one that keeps us long-term bullish on CHPT shares. When this auto led EV charging joint venture is formally announced, we would be surprised if CHPT shares don’t come under some additional pressure. However, knowing the landscape we would view it as an opportunity for members to revisit CHPT shares. While CHPT share are currently about 3.5% of the portfolio’s assets, should this game out as we suspect, we may scoop up some additional shares for the portfolio. Late in the week, ChargePoint secured a new $150 million revolving credit facility with JPMorgan, Citigroup, Goldman Sachs, and HSBC. Alongside that agreement, ChargePoint reiterated it expects to be generating positive EBITDA and cash flow by the end of 2024. Next week Blink Charging (BLNK) and EVgo (EVGO) will report their quarterly results, and we will be interested in what it has to say about 2H 2023 and public funds for building EV charging stations.

1-Wk. Price Change: -1.2% Yield: 0.00%

INVESTMENT THESIS: ChargePoint Holdings designs, develops, and markets networked electric vehicle (EV) charging system infrastructure and cloud-based services which enable consumers the ability to locate, reserve, and authenticate Networked Charging Systems, and to transact EV charging sessions on those systems. As part of ChargePoint’s Networked Charging Systems, subscriptions, and other offerings, it provides an open platform that integrates with system hardware from ChargePoint and other manufacturers. According to the U.S. Department of Energy, the U.S. reached a milestone this past year with its 100,000th EV charger installed in 2021. Industry analysts at Guidehouse Insights forecast that a total of 120 million chargers will be needed globally by 2030, providing a meaningful opportunity for ChargePoint to expand its charging footprint. To that end, the U.S. Departments of Transportation and Energy announced nearly $5 billion over the next five years that will be made available under the new National Electric Vehicle Infrastructure (NEVI) Formula Program established by President Biden’s Bipartisan Infrastructure Law. NEVI aims to build out a national electric vehicle charging network of high voltage chargers along designated Alternative Fuel Corridors, particularly along the Interstate Highway System.

Target Price: Reiterate $15; Rating: One

RISKS: EV adoption of passenger and fleet applications, changing technology, subscription renewals.

ACTIONS, ANALYSIS & MORE: We’re Calling Up a Name From the Bullpen, The Needle Could Begin to Move on This Bullpen Name, Investor Relations.

WEEKLY UPDATE: The catalysts we’ve identified for our shares of Clear Secure are continued expansion of its airport and airline partnerships as well as inroads into other markets. Clear now added the Tulsa International Airport to the fold, bringing the total number of airports served to 53, another step toward the top 75 US airports. We continue to see the company working its way to that target over time, with each new airport opening new markets for its identity verification technology and membership business model. Clear will report its quarterly results on August 2.

1-Wk. Price Change: 1.2%; Yield: 0%

INVESTMENT THESIS: Clear Secure is involved in the creation of a frictionless travel experience while enhancing security. Its secure identity platform uses biometrics to automate the identity verification process through lanes in airports, which helps to make the travel experience safe and easy.

Target Price: Reiterate $37; Rating: One

RISKS: Membership growth, partnership retention, and growth, competitive dynamics, new product offerings.

ACTIONS, ANALYSIS & MORE: We’re Initiating a Position in This Identity Platform Company, We’re Securing This Company a Spot in the Bullpen, Investor Relations.

WEEKLY UPDATE: Oppenheimer boosted its price target on COST shares to $630 from $575, which matches our own price target and the Wall Street consensus of $555. With several headwinds for consumer spending on the horizon, we continue to see Costco picking up further consumer wallet share as it continues to expand its warehouse footprint. Over the last few months, we’ve seen the Wall Street consensus price target as well as COST share price move closer to our $575 target. Should the shares cross the $560 level on a sustained basis, we may be inclined to revisit our current One rating following the almost 23% move since early January.

1-Wk. Price Change: 1% Yield: 0.7%

INVESTMENT THESIS: We like Costco’s long-term prospects, driven by a club-based operating model that focuses on volumes, not margins, and therefore offers its customers a value proposition of everyday low prices. The strength of this model has created an incredibly loyal customer base with low churn and continued share gains in both bricks-and-mortar and e-commerce. And this is a global concept, evidenced by the strength of sales both in the U.S. and abroad, which includes an emerging China opportunity. We see the company’s membership model as a key differentiator vs. other retailers and its plans to open additional warehouse locations in the coming quarters should drive retail volumes and the higher-margin membership fee income as well. We also appreciate management’s approach to capital returns and their willingness to return cash when it is in excess on the balance sheet. Earlier this year, Costco announced a 13.9% increase in its quarterly dividend to $0.90 per share.

Target Price: Reiterate $575. Rating: One

RISKS: Inability to pass through higher costs, fuel prices, weaker consumer, and membership churn.

ACTIONS, ANALYSIS & MORE: FY4Q21 Earnings Analysis (9/23/21), FY2Q21 Earnings Analysis (3/4/21), Upgrading Costco to a One (2/25/21), $10 Per Share Special Dividend (11/16/20), Recent Buy Alert (2/28/20), Initiation (1/27/20), Investor Relations

WEEKLY UPDATE: Coty’s under some pressure after Jefferies cut its rating to Hold from Buy and trimmed its price target to $14 from $16. The argument Jefferies puts forth behind these actions is growing concerns around China related demand as its economic recovery is shaping up to be slower than expected. When it comes to Coty’s business, the China market is a longer-term opportunity and as Coty shared in its recent Paris Investor Day, that market is less than 5% of 2023 sales. Earlier this week, Inter Parfums (IPAR) boosted its outlook for 2023 given strong consumer demand, and luxury goods company LVMH (LVMHF) commented it is seeing a rebound in China activity, also noting Chinese shoppers are buying outside their country. To be blunt, we do not agree with Jefferies decision regarding COTY shares. We would also share that with meaningful upside to its new $14 target, we are somewhat surprised by the rating downgrade assigned to COTY. We recently added to our COTY position and below $12 is a good spot for members that may have missed that trade, especially since it means picking up the shares at a better price than we did. e.l.f. Beauty (ELF) will report on August 1, and based on what we learn we could be back in the market for additional COTY shares.

1-Wk. Price Change: -0.6%; Yield: 0%

INVESTMENT THESIS: Founded in Paris in 1904, Coty is one of the world’s largest beauty companies with a portfolio of iconic brands across fragrance, color cosmetics, and skin and body care. Coty serves consumers around the world, selling luxury and mass market products in more than 130 countries and territories. The company derives almost 45% of its revenue from the Americas, 44% from Europe, Middle East and Africa, and the balance from Asia Pacific. By revenue category, Prestige drives 62% of Coty’s revenue but more than 80% of its operating income with the balance derived from its Consumer Beauty segment. Management intends to further grow the Prestige business, expanding its prestige fragrance brands, through the ongoing expansion into prestige cosmetics, and the building of a comprehensive skincare portfolio leveraging existing brands. Management is also targeting margin improvement at its Consumer Beauty brands as well as expanding its presence in China across both of its reporting segments. China’s beauty and personal care market is expected to grow at a quicker pace of 5.4% per annum through 2027, putting it at $70 billion-$75 billion by 2027.

Target Price: $15; Rating: One

RISKS: Industry competition and consolidation, product efficacy and safety, currency, brand licensing.

ACTIONS, ANALYSIS & MORE: We’re Making Our Portfolio a Little More Beautiful Today, We’re Adding a Name to the Bullpen, Investor Relations.

WEEKLY UPDATE: Late this week, farm equipment company AGCO reported stronger than expected June quarter results and lifted its 2023 revenue as well as EPS guidance. The company’s June quarter revenue rose ~30% year over year led by high horsepower ag equipment as well as precision ag equipment demand. Per AGCO, the current average age of high horsepower tractors in the US is approximately 7.5 years old, a year older than the historical average. We see this boding well not only for replacement demand but also for upgrades to more productive precision ag equipment at a time when farmer income remains at historically high levels. In our view this bodes extremely well for Deere shares. Deere will report its quarterly results on August 18.

1-Wk. Price Change: -2.2% Yield: 1.2%

INVESTMENT THESIS: The global agriculture equipment market size is expected to reach $166.5 billion in 2027, growing at a 6% CAGR over the 2020-2027 period. The favorable outlook for equipment purchases in the coming quarters reflects rising farmer income that historically drives new equipment purchases. At the same time, Deere continues to lean into the sustainability movement with its precision ag offering. That technology is helping farmers drive crop yields higher while also realizing cost savings, which makes the new technology a productivity upgrade compared to older equipment. In February, Deere announced a 4.2% in its quarterly dividend per share to $1.25 from $1.20.

Price Target: Reiterate $500; Rating: One.

RISKS: Geopolitical uncertainty, economic conditions, raw material, and other input prices, prices for key agricultural commodities.

ACTIONS, ANALYSIS & MORE: Initiation (10/25/21), Investor Relations

WEEKLY UPDATE: Last week saw Elevance explode higher following some strong earnings and the stock followed through this week with some good volume and improved technical indicators. Yet, the stock struggled at the key 200 day moving average, which served as brick wall this past week. After a big surge such as we saw from ELV we would expect to have the stock pull back a bit. During the week, analysts raised targets and kept Buy and Outperform ratings, including Morgan Stanley and Cowen. Elevance will pay its third-quarter dividend of $1.48 per share on Sept. 22 to shareholders of record as of Sept. 8.

1-Wk. Price Change: -1.9%; Yield: 1.3%

INVESTMENT THESIS: Elevance, formerly Anthem/Blue Cross Health, is a premier health care brand that appears to be in the sweet spot for HMO companies. Mostly domestic, this company has a wide reach and coverage across the U.S., serving more than 118 million people via medical, pharmacy, clinical, and care solutions. Founded in 1944, Elevance offers a terrific business model that works in boom or bust economic times. The opportunity to find a company with reliable and dependable revenue and cash flows is right here with Elevance. Revenue growth for this company has surged in recent years, with better than double-digit growth since 2018 as the company thrived during the pandemic.

Target Price: Reiterate $550; Rating: One

RISKS: With any insurance business the risk is high for changes in regulation and government programs. Since the onset of Obamacare more than 10 years ago, companies like Elevance have changed their model to be more in line with a better cost/benefit analysis, reducing waste and squeezing out excesses (as was outlined and suggested in Obamacare). Separately, as the population increases and ages, there is more opportunity for Elevance to grow, but with those changes, there is a risk. Lastly, competition is brisk with some very strong opponents who keep their costs low (Humana, Cigna, UNH, CVS/Healthnet).

ACTIONS, ANALYSIS & MORE: We’re Trimming One Stock to Add to Another, 2021 Annual Report, 2Q 2022 Earnings Report, Investor Relations.

TWOs

WEEKLY UPDATE: June quarter results at Alphabet topped consensus expectations with EPS of $1.44 per share on revenue that rose 7.1% year over year to $74.6 billion, well ahead of the $72.85 billion consensus. The company’s operating margin expanded to 29% from 28% in the year ago quarter and 25% in the March quarter, showing the company’s efforts to manage costs is paying off. We’d note improved profitability across the company’s three major reporting segments – Google Services, Google Cloud, and Other Bets. Google Cloud saw its profitability continue to improve quarter over quarter vs. being a drag on overall profitability last year. Management reiterated it will continue to slow expense growth and its pace of hiring but ensure it continues to invest in key areas. One of those, which should come as no surprise, is AI. That was the company’s largest capex item in the June quarter, and it sees “elevated levels of investment in our technical infrastructure increasing through the back half of 2023 and continuing to grow in 2024.” Favorable prospects for the advertising and cloud businesses along with continued focus on cost at Google Cloud and other areas should have Wall Street taking a more favorable view on GOOGL shares. While expectations for recognizing AI benefits to the bottom line are likely to be pushed out, the degree of that push out doesn’t appear to be as large as the one at Microsoft. While we boosted our price target to $145 from $135 this week, we will hold off from upgrading them to a One rating but will look to review our Two rating should they pull back below the $120 level.

1-Wk. Price Change: 10.5%; Yield: 0.00%

INVESTMENT THESIS: We believe that while search and digital ad dominance are what will carry shares in the near- to- mid-term, longer-term it is the company’s artificial intelligence “moat” that will provide for new avenues of growth. AI is what has made the company’s search, video and targeted ad capabilities best-in-class and is the driving force behind the company’s success in voice (Google Home) and autonomous driving (Waymo). Furthermore, we believe it is this AI expertise that will also make the company more prevalent in other industries, including healthcare via subsidiary Verily, as AI and machine learning continue to disrupt operations across industries. Lastly, compounding out positive view of the company’s future opportunities, we believe that Alphabet’s free cash flow generation and solid balance sheet set it apart and are what will allow the company to continue taking chances on far-out ground-breaking and potentially world-changing projects.

Target Price: Reiterate $145; Rating: Two

RISKS: Regulatory risk (data privacy), competition, macroeconomic slowdown impacting consumers and therefore ad buyer activity.

ACTIONS, ANALYSIS & MORE: FY2Q21 Earnings Analysis (7/27/21), Why GOOGL Has Shrugged Off Antitrust Headlines in Early Trading Tuesday (10/20/20)

WEEKLY UPDATE: American Water reported June quarter results that topped top and bottom-line expectations, reiterated its prior guidance for 2023 as well as doing the same for its longer-term EPS and dividend growth targets of 7%-9% through 2027. The company continues to benefit from its expanding footprint, and petitions for higher water rates keeping American Water on path through 2027 with its EPS and dividend growth targets. Upside to the company’s 2023 guidance could be had depending on acquisition timing, and management indicated it has over $550 million of acquisitions under agreement, including those two sizable deals. Also, in 2H 2023, the company has several general rate increases pending, including ones in California, Indiana, general rate cases in California and Indiana, Kentucky, and Missouri. The company has a solid and expanding base, which paired with additional rate adjustments should help it grow its EPS by 40%-50% between 2022 and 2027, with the same likely for its annual dividend. That gives us a long-term path for AWK shares and argues for the shares steadily moving higher over that time frame. That said, we also understand how the shares trade, which means if the historical seasonal move in AWK shares plays out, we would look to book at least some gains later in the quarter, buying back the shares during the seasonally week December and March quarters.

1-Wk. Price Change: -1.3%; Yield: 1.9%

INVESTMENT THESIS: American Water is the largest and most geographically diverse, publicly traded water and wastewater utility company in the United States, as measured by both operating revenues and population served. The company’s primary business involves the ownership of utilities that provide water and wastewater services to residential, commercial, industrial, public authority, fire service, and sale for resale customers. The company’s utilities operate in approximately 1,700 communities in 14 states in the United States, with 3.4 million active customers in its water and wastewater networks. Services provided by the company’s utilities are subject to regulation by multiple state utility commissions or other entities engaged in utility regulation, collectively referred to as public utility commissions (PUCs). Residential customers make up a substantial portion of the company’s customer base in all of the states in which it operates. The company also serves (i) commercial customers, such as food and beverage providers, commercial property developers and proprietors, and energy suppliers, (ii) fire service customers, where the company supplies water through its distribution systems to public fire hydrants for firefighting purposes and to private fire customers for use in fire suppression systems in office buildings and other facilities, (iii) industrial customers, such as large-scale manufacturers, mining and production operations, (iv) public authorities, such as government buildings and other public sector facilities. Because there is usually only one water utility available, the business has a rather wide moat, and the company has used its scale and balance sheet to acquire smaller, regional water utilities thereby further expanding its scale.

Target Price: Reiterate $165; Rating: Two

RISKS: Regulatory oversight risks, environmental safety laws, and regulations, weather-related service disruptions.

ACTIONS, ANALYSIS & MORE: We’re Initiating 1 Name While Adding to Another Initiating a Position in This Public Water Utility Company, Investor Relations presentation.

WEEKLY UPDATE: Quarterly results and guidance from semi-cap company Lam Research lifted our shares of Applied Materials. Lam’s $1.8 billion in deferred revenue along with rebounding orders led it to guide current quarter revenue to $3.1 billion-$3.7 billion vs. the $3.2 billion recorded in the June quarter. Also helping provide some lift to AMAT shares was the year over year improvement in gross margin to 45.7% vs. 44.0% in the year ago quarter. Continued improvement in supply chains, higher volumes that drive fixed cost absorption and pricing were factors behind that, all of which should be in place at Applied as well. On its earnings conference call, Intel (INTC) shared that while its gross capital spending plans have not changed there could be some slippage into 2024. We view that as timing issue more than anything. Intel continues to strategically invest in manufacturing capacity and during the quarter announced the selection of Wrocław, Poland, as the site of a new cutting-edge semiconductor assembly and test facility. Intel expects to invest as much as $4.6 billion in that facility alone before 2027. Our reason for wanting to own AMAT shares ties to the re-shoring of chip capacity, not only in the US but also the eurozone and Japan. We knew the flow of stimulus funds to re-shore that capacity would only start to flow in 2H 2023 and run for multiple years.

1-Wk. Price Change: 11.4% Yield: 0.8%

INVESTMENT THESIS: Applied provides manufacturing equipment, services and software to the semiconductor, display, and related industries. With its diverse technology capabilities, Applied delivers products and services that improve device performance, power, yield and cost. Applied’s customers include manufacturers of semiconductor chips, liquid crystal and organic light-emitting diode (OLED) displays, and other electronic devices. Applied operates in three reportable segments: Semiconductor Systems (73% of 2022 revenue, 78% of 2022 operating income), Applied Global Services (22%, 19%), and Display and Adjacent Markets (5%, 2%). Key customers include Samsung (12% of 2022 sales), Taiwan Semiconductor (20%), and Intel (10%). The company has a rising dividend bias with the current annualized dividend reaching $1.28 per share vs. the 2017 dividend of $0.43 per share and 2018’s $0.64 per share.

Target Price: Reiterate $145; Rating: Two

RISKS: Manufacturing and Supply Chain, Competitive Factors, Government Regulation, Technology Change.

ACTIONS, ANALYSIS & MORE: We’re Pulling This Name Up From the Bullpen, Investor Relations.

WEEKLY UPDATE: Chipotle Mexican Grill reported results that topped expectations for the June quarter, but while Chipotle continues to expect mid to high single-digit comp growth for the year, it anticipates low to mid-single-digit comps for the current quarter as it starts to lap 2022 pricing action. Management also telegraphed some incremental margin headwinds owing to higher beef and avocado prices. Our response to those modest outlook revisions is to reduce our price target to $2,100 from $2,200 and with the pre-market fall to around the $1,900 level we will keep our Two rating in play. Ahead of this earnings report, our recommendation to members was to pick up CMG shares near $1,900, but in revising our price target we are lowering that recommendation to $1,850. Let’s remember one of the keys to restaurant stocks is footprint expansion. Management continues to target opening 255 to 285 restaurants this year with 80% including a “chipotlane” and it reiterated its long-term target of 7,000 restaurants in North America versus its total footprint of more than 3,250 locations exiting the quarter. As we noted above, Chipotle’s fast-casual nature and management’s smart use of limited time menu offerings has it well-positioned as consumers continue to rethink how they doll out their disposable income, especially with the resumption of student debt payments. We suspect the market eventually will come around to our thinking on this.

1-Wk. Price Change: -8.9% Yield: 0.00%

INVESTMENT THESIS: Our investment thesis on CMG shares centers on its offering consumers better-for-you fare while also expanding its geographic density, embracing digital ordering, and bringing to market limited-time menu offerings that should spur traffic and boost average revenue per ticket. With the upside to our price target shrinking, we are once again reviewing the incremental upside and revisiting protein input costs.

Target Price: Reiterate $2,100; Rating: Two

RISKS: Input costs, particularly for the protein complex, labor costs, consumer spending, food safety, industry dynamics, and competition.

ACTIONS, ANALYSIS & MORE: Initiating a New Position in Chipotle, We’re Adding Chipotle to the (Bullpen) Menu

WEEKLY UPDATE: Oil prices are tracking for a fifth straight week of gains following the preliminary 2Q 2023 GDP print that suggested a soft landing for the economy is increasingly likely. That led our XLE shares higher, shrugging off modest earnings misses from Exxon Mobil (XOM) and inline results from Chevron (CVX). With expected cuts by OPEC and its allies, the concern is supplies could be tight as the economy performs better than expected. This led UBS to issue bullish comments on the oil market, sharing a view it sees Brent prices rising to $85-$90 from below $84 in the coming months. We have the next OPEC+ on August 4, and we look forward to its comments about overall demand, but we will be mindful for comments on supply expectations in the coming months.

1-Wk. Price Change: 1.8%; Yield: 3.9%

INVESTMENT THESIS: Energy Select Sector SPDR Fund is an exchange-traded fund (ETF) that tracks the performance of the Energy Select Sector Index. The ETF holds large-cap U.S. energy stocks. It invests in companies that develop & produce crude oil & natural gas and provide drilling and other energy-related services. The holdings are weighted by market capitalization.

Target Price: Reiterate $98; Rating: Two

RISKS: Interest rates, weakness in the broad economy, energy prices.

ACTIONS, ANALYSIS & MORE: Adding to 2 Positions on Market Weakness, We’re Initiating a Position in the Energy Sector, State Street Global Advisors SPDR Fact Sheet for XLE.

WEEKLY UPDATE: U.S. government services contractor Maximus has confirmed that hackers accessed the protected health information of as many as 11 million individuals. CIBR constituent Check Point Software reported June quarter results that topped expectations as the cyber threat arena continues to expand. Checkpoint commented longer deal cycles continue to be a factor, but renewal rates remain robust even amid vendor consolidation. That activity, vendor consolidation, is another reason why we prefer to own a basket of cybersecurity companies via this ETF than anyone individual cybersecurity company. Next week brings quarterly results from other CIBR constituents, including Fortinet and Radware. While the portfolio has a full position, we would encourage new members to pick up CIBR shares below $43 and be more aggressive near $40.

1-Wk. Price Change: 1.6% Yield: 0%

INVESTMENT THESIS: The First Trust Nasdaq Cybersecurity ETF seeks investment results that correspond generally to the price and yield (before the fund’s fees and expenses) of an equity index called the Nasdaq CTA Cybersecurity Index. The Nasdaq CTA Cybersecurity Index is designed to track the performance of companies engaged in the cybersecurity segment of the technology and industrial sectors. It includes companies primarily involved in the building, implementation, and management of security protocols applied to private and public networks, computers, and mobile devices to protect the integrity of data and network operations. To be included in the index, a security must be listed on an index-eligible global stock exchange and classified as a cybersecurity company as determined by the Consumer Technology Association. Each security must have a worldwide market capitalization of $250 million, have a minimum three-month average daily dollar trading volume of $1 million, and have a minimum free float of 20%.

Target Price: Reiterate $62; Rating: Two

RISKS: Cybersecurity spending, technology, and product development, timing of product sales cycle, new products, and services in response to rapid technological changes and market developments as well as evolving security threats.

ACTIONS, ANALYSIS & MORE: We’re Swapping One Cybersecurity Stock for Another, ETF Product Summary

WEEKLY UPDATE: There was plenty of news for Lockheed this week following last week’s reported second-quarter earnings. The company won several contracts this week, a theme we have seen recently with some solid wins versus its competitors. Over the week Lockheed won long term contracts from the Navy and other branches totaling nearly one billion dollars. NASA funds were placed with Lockheed, among a dozen companies that are looking to develop long term expiration of the moon and space. Lastly, in a $6.6 billion deal, the Australian Air Force purchased 20 LMT C-130J Hercules aircraft. Thursday night, the Senate passed a national defense spending bill that sets topline spending at $886 billion and includes support for Ukraine through 2027. The House passed its own version of the bill, the National Defense Authorization Act, and lawmakers will now have to reconcile their respective bills to a version that can pass both chambers.

1-Wk. Price Change: -1.3% Yield: 2.7%

INVESTMENT THESIS: Lockheed Martin is the largest defense contractor globally and has dominated the Western market for high-end fighter aircraft since the F-35 program was awarded in 2001. Lockheed’s largest segment is aeronautics, which is dominated by the massive F-35 program. Lockheed’s remaining segments are rotary and mission systems, which is mainly the Sikorsky helicopter business; missiles and fire control, which creates missiles and missile defense systems; and space systems, which produces satellites and receives equity income from the United Launch Alliance joint venture. Historically, the stability of defense spending has been a haven during periods of economic uncertainty, and we see that repeating once again even as geopolitical conflicts are likely to lead to incremental demand for Lockheed’s products. The company has increased its dividend consistently over the last 19 years and is widely expected to boost it again in the coming days. In October 2022, Lockheed announced its board authorized the purchase of up to an additional $14.0 billion of LMT stock under its share-repurchase program. Entering 2023, Lockheed should have around $10 billion in share repurchase to be used over the ensuing 11 quarters.

Target Price: $520; Rating: Two

RISKS: Contracts and budget risk with the U.S. government and the Department of Defense, F-35 program funding and renewal, competition, subcontractor issues.

WEEKLY UPDATE: Following upbeat quarterly results from American Express and Visa that showed consumers continued to spend, Mastercard reported June quarter results that topped expectations. Cross-border volume growth rose 24% year over year with cross-border travel volume posting strong growth. During the earnings call, management commented domestic spending volumes remains healthy and China related travel is improving. The company reiterated its net revenue growth forecast for 2023 that sees low teens growth on a currency-neutral basis excluding acquisitions and special items. Given the company’s revenue mix (~65% outside of the US) it will benefit from the weaker dollar and the emergence of real wage growth in the US, but we will want to monitor consumer spending in key markets outside the US. Should signs that is holding up better than expected given recent PMI data emerge, we will revisit our MA price target even though others are boosting their targets late this week. Wells Fargo boosted its target to $440 from $425, Credit Suisse to $430 from $400 and Morgan Stanley lifted its to $443 from $440. We will also be mindful of student debt payments resuming in October. Mastercard will pay its next $0.57 dividend on August 9.

1-Wk. Price Change: -1.1% Yield: 0.6%

INVESTMENT THESIS: Mastercard is a card network company that benefits from the secular shift away from cash transactions and toward card-based and electronic payments. On Covid-19 dynamics, we view MA as a “reopening” play and an economic recovery play within technology because its cross-border volumes fell sharply during the pandemic but will rebound as mobility increases and travel restrictions ease. Mastercard has more international exposure relative to Visa, making its growth outlook more susceptible to new travel restrictions. However, we view MA as the better long-term play as we are betting on that inevitable recovery.

Target Price: Reiterate $430 Rating: Two

RISKS: The recovery in cross-border transactions, regulation in payments market, competition from other fintechs, pricing pressures.

WEEKLY UPDATE: As we trade a seasonally stronger time of year for the market to a seasonally weaker one and move another layer into the June quarter earnings season, we will continue to hold our PSQ shares. However, we are mindful the domestic economy continues to fare better than expected and inflation is slowing. Should we see further evidence of both and signs points to the Fed nearing the end of its rate hiking cycle we may look to exit our PSQ shares.

1-Wk. Price Change: -2%; Yield: 0.0%

INVESTMENT THESIS: ProShares Short QQQ seeks daily investment results, before fees and expenses, that correspond to the inverse (-1x) of the daily performance of the Nasdaq 100 Index. The Nasdaq 100 Index includes 100 of the largest domestic and international non-financial companies listed on The Nasdaq Stock Market based on market capitalization.

Target Price: N/A; Rating Two

RISKS: Because PSQ shares track the inverse of the Nasdaq 100 Index, PSQ shares will move lower when the Nasdaq 100 Index moves higher.

ACTIONS, ANALYSIS & MORE: Selling Shares in 1 Position, Closing Another, Adding to 1, and Initiating 1

WEEKLY UPDATE: As we trade a seasonally stronger time of year for the market to a seasonally weaker one and the S&P 500 once again flirting with overbought conditions, we will continue to hold our SH shares. However, we are mindful the domestic economy continues to fare better than expected and inflation is slowing. Should we see further evidence of both and signs points to the Fed nearing the end of its rate hiking cycle we may look to exit our SH shares.

1-Wk. Price Change: -0.9%; Yield: 0.0%

INVESTMENT THESIS: The ProShares Short S&P 500 ETF seeks daily investment results, before fees and expenses, that correspond to the inverse (-1x) of the daily performance of the S&P 500. We are using SH shares to blunt market volatility and hedge the portfolio’s performance against its benchmark, the S&P 500. Given the tactical nature of this position, we do not expect to hold SH shares for the same length of time as we do the portfolio’s long positions.

Target Price: N/A; Rating Two

RISKS: Because SH shares track the inverse of the S&P 500, SH shares will move lower when the S&P 500 moves higher.

ACTIONS, ANALYSIS & MORE: Selling Shares in 1 Position, Closing Another, Adding to 1 and Initiating 1.

WEEKLY UPDATE: Gold was making a strong case for $2,000 per ounce and we saw a tick above there early Thursday, but it was not to be. Gold finished the day poorly as did the GLD, which closed under the 20-day moving average for the first time since July 10. We still see the GLD ETF in a sideways range and consolidation, buyers stepping in at the mid/high 170’s and the sellers stepping in mid 180’s. We still like GLD as a diversifier and if the dollar suddenly weakens, holding this ETF will be a benefit to the portfolio (as gold often moves against the greenback).

1-Wk. Price Change: -0.2% Yield: 0.0%

INVESTMENT THESIS: The GLD ETF is a proxy for gold. This “trust” buys and sells gold futures each day to mimic the daily moves in the underlying asset, in this case, gold. We see gold as an ideal hedge against a weaker dollar, strong inflation (which tends to weaken the dollar) alternative, and in uncertain times (worry over war and battles). For the past 15 years, gold has been a strong asset class held by fund managers, countries, and banks. The metal is not correlated with markets and will move based on the demand/supply dynamic in the marketplace. Other precious metals such as silver and platinum are good proxies for the criteria stated earlier, however, gold is far more liquid and offers better upside opportunities.

Target Price: Reiterate $200; Rating: Two

RISKS: Weak inflation data, interest rate risk, dollar strength relative to other currencies, geographic risk.

WEEKLY UPDATE: We see Trinity benefitting from 2Q 2023 bank failures as it as it helped fill the venture lending void left by those failures. In recent weeks, Trinity has also announced several key hires that should improve its competitive positioning in the second half of 2023. The company will report its June quarter on Thursday, August 3, after the market close.

1-Wk. Price Change: -1.7%; Yield: 14.1%

INVESTMENT THESIS: Trinity Capital is a Business Development Company (BDC) that provides debt, including loans and equipment financings to growth-stage companies, including venture-backed companies and companies with institutional equity investors. Trinity aims to generate current income and, to a lesser extent, capital appreciation through its investments. It does this by making investments consisting primarily of term loans and equipment financings and, to a lesser extent, working capital loans, equity, and equity-related investments. Because Trinity is a BDC, it must pay out at least 90% of its net income to shareholders in the form of dividends. Trinity is positioned to fill the gap left by recent bank failures and shareholders should benefit as that lifts the company’s investment portfolio and income stream, and its dividend payout to shareholders.

Target Price: $16; Rating Two

RISKS: Global economic, political and market conditions; regulations governing our operations as a BDC; credit facility provisions

ACTIONS, ANALYSIS & MORE: Let’s Dig Into the Thesis Behind Our Newest Position, As Banks Start Tightening Up on Loans, Let’s Check This Bullpen Stock, Listen as We Make a Bullpen Pick — and Talk Business Development Cos.; Investor Relations.

WEEKLY UPDATE: United Rentals crushed quarterly earnings per share expectations for the June quarter, delivering $9.88 per share vs. the $8.94 consensus and $7.86 in the year-ago quarter. Revenue for the quarter clocked in at $3.55 billion, up more than 28% year over year, of which $2.98 billion was rental revenue, up 21% year over year. That demand was broad-based across verticals, regions, and customer segments, while fleet productivity increased 2.1% on a pro forma basis. Based on the strength of its end markets, United upped its 2023 revenue forecast to $14.0 billion to $14.3 billion vs the $14.12 consensus and its prior guidance of $13.7 billion to $14.2 billion. The company also boosted its earnings before interest, taxes, depreciation, and amortization guidance by $100 million to $6.75 billion to $6.90 billion. Management said on the earnings call it’s on track to return over $1.4 billion in cash to shareholders through a combination of dividends and buybacks, which suggest around $0.7 billion in the second half of 2023, essentially matching what it did in the first half of the year. In response, we lifted our URI price target to $500 from $475, which leaves low double-digit upside from the current share price. While tempting, it’s not quite enough for warrant an upgrade to a “One” rating. If we see the shares pullback below $425, we would look to reconsider the current Two rating, potentially becoming even more aggressive in the shares closer to $400.

1-Wk. Price Change: -1% Yield: 1.3%

INVESTMENT THESIS: United Rentals, the largest equipment rental company in the world, operates throughout the United States and Canada, and has a limited presence in Europe, Australia, and New Zealand. It serves industrial and other non-construction; commercial (or private non-residential) construction; and residential construction. Industrial and other non-construction rentals represented approximately 50% of rental revenue, primarily reflecting rentals to manufacturers, energy companies, chemical companies, paper mills, railroads, shipbuilders, utilities, retailers, and infrastructure entities; commercial construction rentals represented approximately 46% of rental revenue, primarily reflecting rentals related to the construction and remodeling of facilities for office space, lodging, healthcare, entertainment, and other commercial purposes; and residential rentals around 4% of revenue. We see the company benefiting on three fronts — the seasonal uptick in construction spending; the release of funds and projects associated with the five-year Biden Infrastructure Bill; and the company’s nip-and-tuck acquisition strategy that should further enhance its geographic footprint. In January, the company announced a fresh $1 billion buyback authorization following the completion of $4 billion in share repurchases over the 2012-2021 period.

Target Price: Reiterate $500; Rating: Two

RISKS: Industry and economic risk, competition and competitive pressures, and acquisition risk.

ACTIONS, ANALYSIS & MORE: Initiating a Position in This Equipment Rental Company, We’re Adding This Equipment Rental Company to the Bullpen, Investor Relations

WEEKLY UPDATE: As expected, Samsung introduced new foldable smartphone models at its Unpacked event this week to generally positive reviews. Data suggests up to 50% of smartphone users are considering an upgrade to foldable models. We continue to see the update of those models as well as other smartphone models with larger organic light emitting diode displays driving incremental demand for Universal’s solutions. In the coming weeks, we will also be gathering comments from RF semiconductor companies for what they see for the smartphone market in 2H 2023. Other current end markets we will be keeping tabs on include TVs and wearables. Should additional signs confirm the seasonal ramp in smartphone production is unfolding, we would look to add to our OLED position. During the week, Goldman Sachs upped its price target on OLED shares to $168 from $164.

1-Wk. Price Change: 0.7% Yield: 1.0%

INVESTMENT THESIS: Universal Display focuses on the development and commercialization of organic light emitting diode (OLED) technologies and materials for use in display and solid-state lighting applications. OLED displays are capturing a growing share of the display market, especially in the mobile phone, television, monitor, wearable, tablet, notebook and personal computer, augmented reality (AR), virtual reality (VR) and automotive markets. This adoption reflects advantages over competing display technologies with respect to power efficiency, contrast ratio, viewing angle, video response time, form factor and manufacturing cost. Universal’s business strategy is to develop new OLED materials and sell existing and new materials to product manufacturers for display applications, such as mobile phones, televisions, monitors, wearables, tablets, portable media devices, notebook computers, personal computers and automotive applications, and specialty and general lighting products. The company also looks to license its OLED material, device design and manufacturing technologies to those manufacturers. As such, Universal has a significant portfolio of proprietary OLED technologies and materials with more than 5,500 patents issued and pending worldwide.

Target Price: Reiterate $160 Rating: Two

RISKS: Patent and Intellectual property protection; maintaining OLED manufacturing and customer relationships; technology risk; market risk.

ACTIONS, ANALYSIS & MORE: We’re Initiating a New Position Out of the Bullpen; Let’s Visit Two Bullpen Stocks; Universal Display Investor Relations.

WEEKLY UPDATE: Positive comments from portfolio holding United Rentals confirms our positive view on VMC shares. When competitor Martin Marietta reported earnings this week, it reaffirmed our view that legislation, including the Biden Infrastructure Law, Inflation Reduction Act and the CHIPs Act, should provide sustainable demand for the next few years. Backing that view, Martin shared the value of state and local government, highway, bridge, and tunnel contract awards rose 25% to a record $114 billion for the 12-month period ending May 31. In terms of margins, Martin’s gross margin jumped 440 basis points year over year, led by pricing and moderating energy expenses, factors that should replicated at Vulcan. Next week brings quarterly results from construction equipment companies Caterpillar (CAT) and Terex (TEX), and their comments on infrastructure and nonresidential construction demand for their equipment will add another point of reference for aggregate demand. Vulcan will report its quarterly results on August 3. Vulcan recently announced its next quarterly dividend of $0.43 per share will be paid on September 6 to shareholders of record on August 17.

1-Wk. Price Change: -0.9% Yield: 0.8%

INVESTMENT THESIS: Vulcan Materials operates primarily in the U.S. and is the nation’s largest supplier of construction aggregates (primarily crushed stone, sand, and gravel), a major producer of asphalt mix and ready-mixed concrete, and a supplier of construction paving services. Its products are the indispensable materials used in building homes, offices, places of worship, schools, hospitals, and factories, as well as vital infrastructure including highways, bridges, roads, ports and harbors, water systems, campuses, dams, airports, and rail networks. Ramping spending associated with the Biden Infrastructure Law should drive demand for Vulcan’s products over the coming years. Vulcan has historically complemented its organic growth prospects by acquiring businesses to expand its geographic reach and product scope. Since 2014, the company has acquired more than two-dozen companies, including the 2021 acquisition of U.S. Concrete. That combination has allowed the company to deliver steady top and bottom-line growth over the last decade, with only a modest decline when the pandemic hit in 2020.

Target Price: Reiterate $250; Rating: Two

RISKS: General economic and business conditions; dependence on the construction industry; timing of federal, state, and local funding for infrastructure; changes in the level of spending for private residential and private nonresidential construction.

ACTIONS, ANALYSIS & MORE: Initiation Post, Investor Relations

THREEs

WEEKLY UPDATE: Amazon reduced its takeover offer for iRobot to $51.75 per share down from $61 following ongoing antitrust headwinds that companies have faced both domestically and in Europe, which has seemingly impacted iRobot’s bottom line. While the U.K. finally approved the acquisition last month, the European Commission confirmed this won’t be resolved until November at the very earliest. Also, this week, Amazon announced job cuts at its Fresh Grocery stores as part of a US restructuring plan for that business that currently spans 44 locations across the U.S. CEO Andy Jassy has pointed to grocery as a big growth opportunity for Amazon, but also shared the company has yet to find at “mass grocery format” that works. Politico reported this week the U.S. Federal Trade Commission is finalizing an antitrust lawsuit against Amazon, something we will add to our pile of regulatory items to watch across the portfolio. The complaint is anticipated focus on challenging practices of the Amazon Prime business and policies the FTC believes force merchants to use Amazon’s logistics and advertising services. This follows Amazon offering to change its marketplace rules to address competition concerns raised by the UK’s Competition and Markets Authority. When Amazon reports next week, we’ll be looking for signs its cost cutting efforts are giving way to margin improvement as well as confirmation Amazon Web Services is still growing and is poised to benefit from customer adoption of AI. For Amazon’s retail business, we’ll be assessing its guidance against its 2023 Prime Day performance as well as indications the company will hold another Prime event later this year like it did last year. Reports indicate marketplace sellers are being told of a second such event later this year and have an August 11th deadline to submit deals for the event. Following the company’s June quarter report and guidance, we will update our price target as needed.

1-Wk. Price Change: 1.7%; Yield: 0.0%

INVESTMENT THESIS: We believe upside will result from Amazon’s continued eCommerce dominance, AWS’ continued leadership in the public cloud space, and ongoing growth of the company’s advertising revenue stream, which feeds off Amazon’s eCommerce business. Additionally, we believe profitability will continue to improve as AWS and advertising account for a larger portion of total sales as both these segments sport higher margins than the eCommerce operation. And while we believe the increasing share of revenue from these higher margin businesses will be key to driving profitability longer-term, we believe margins on eCommerce stand to improve as the company’s infrastructure is further built out and economies of scale further kick in. The embedded call option is that management is always looking to enter a new space and generate new revenue streams.

Target Price: Reiterate $145; Rating: Three

RISKS: High valuation exposes the stock to volatile swings, eCommerce has exposure to slower consumer spending, and competition, management is not afraid to invest heavily, potential headwinds resulting from new eCommerce regulation in India, and management is not scared to invest aggressively for growth, which can at times cause volatile reactions as near-term concerns arise relating to the impact on margins.

ACTIONS, ANALYSIS & MORE: FY2Q21 Earnings Analysis (7/29/21), 2020 Letter to Shareholders (4/15/21), Initiation (2/2/18), Investor Relations

WEEKLY UPDATE: So far, this earning season, we’ve received indications the seasonal ramp for smartphones is poised to play out once again. Those signs point to firmer demand for premium models, which bodes well for Apple’s iPhone offering. This week CounterPoint Research reported iPhone accounted for 55% of smartphone shipments in the U.S. during 2Q 2023 up from 52% in 1Q 2023 and 45% in 2Q 2022. In the China market, data from IDC indicates iPhone sales rose 6.1% on a year over year basis in 2Q 2023, gaining share as overall smartphone sales in China fell 2.1% year over year during the quarter. Those figures along with share gains we discussed previously for Apple’s Mac products during the quarter suggests we should see another solid quarter from the company when it reports next week. During the earnings call, we will be interested to see how management discusses a potential $1 billion class action lawsuit brought by over 1,500 apps developers in the U.K. linked to its App Store fees. Setting the stage for Apple’s earnings will be quarterly results from Bullpen resident Qualcomm (QCOM) and Qorvo (QRVO) the day before.

1-Wk. Price Change: 2% Yield: 0.5%

INVESTMENT THESIS: While we acknowledge that near-to-midterm performance remains heavily influenced by iPhone sales, the dynamic is shifting as investors finally place greater emphasis on Services growth. We are bullish on the 5G upgrade cycle and believe longer-term upside will continue to come as Services revenue grows its share of overall sales. Services provide for a recurring revenue stream at higher margins, a factor that serves to reduce earnings volatility while allowing for a higher percentage of sales to fall to the bottom line; as a result, we believe that Services growth and the installed base, are much more important than how many devices the company can sell in each 90-day period. In addition to improved profitability, we also believe the transparent nature of this revenue stream will demand an expanded price-to-earnings multiple as segment sales grow. Furthermore, we believe that Apple’s desire to push deeper into the healthcare arena will help make its devices invaluable as more life-changing features are added and the company works to democratize health records. Lastly, also see upside resulting from increased adoption of wearables (think the Apple Watch) and potential new product announcements such as an AR/VR headset or an update on project Titan, the company’s secretive autonomous driving program.

Target Price: Reiterate $185; Rating: Three

RISKS: Slowdown in consumer spending, competition, lack of new product innovation, elongated replacement cycles, failure to execute on Services growth initiative.

ACTIONS, ANALYSIS & MORE: FY3Q21 Earnings Analysis (7/27/21), Apple Product Launch Event Takeaways (4/20/21), Takeaways from WWDC (6/22/20), Initiation (1/4/10), Investor Relations

WEEKLY UPDATE: Not much news on the CBOE this week but we did continue to see robust option trading following a big July monthly option expiration. The stock traded up to an all-time high once again, so we used that opportunity to trim the stock and add to two other portfolio positions. As we enter seasonally weak period and investors watching for a market pullback, we are likely to see a positive impact to options volume at Cboe in the coming weeks. Our thinking is that will set the company up for favorable guidance when it reports its quarterly results on August 4. As we assess that report, we’ll determine what’s next for this Three rated position.

1-Wk. Price Change: -1.9% Yield: 1.4%

INVESTMENT THESIS: Cboe’s business centers on market infrastructure, data solutions, and tradable products for equities, derivatives, and foreign exchange across North America, Asia Pacific, and Europe. Those operations include the largest options exchange and the third largest stock exchange operator in the U.S., one of the largest stock exchanges by value traded in Europe, and EuroCCP, a leading pan-European equities and derivatives clearinghouse among others. The two primary drivers of the company’s earnings are its options and North American equities business, which, combined, drive around 75% of its revenue but more importantly roughly 85% of its operating income. Cboe operates four U.S. options exchanges — the Cboe Options, C2 Options, EDGX Options and BZX Options Exchanges — which together account for approximately 31% of all U.S. options trading volume. Viewed from a different perspective, 28%-30% of Cboe’s revenue stream is from recurring non-transaction revenue that includes proprietary market data as well as access and capacity fees. We like the sticky nature and predictability of that business. The core driver of the company’s business hinges on continued growth in options trading volume and the company expanding its recurring non-transaction revenue.

Target Price: Reiterate $140; Rating: Three.

RISKS: IT spending, competition, supply chain challenges

ACTIONS, ANALYSIS & MORE: Addition to AAP Portfolio; Initial Technical Review, Addition to Bullpen, Investor Overview.

WEEKLY UPDATE: During the week we shared rising spending on AI and data center by Microsoft and Alphabet points to a stronger outlook at Marvell. Later in the week, Jefferies echoed that view. NXP Semiconductor issued favorable comments for its Communication, Infrastructure, and Other segment, while chip demand for its Automotive segment remains solid. When it reported its quarterly results, Intel commented data center remains strong as does AI related demand. We see both comments adding another layer of support for our position in MRVL. Marvell will report its quarterly results on August 24. As we get ready for that report, we will revisit our current price target with an upside bias. During the week, Wolfe Research initiated coverage on MRVL shares with an Outperform rating and a fresh $80 target vs. the $68 consensus.

1-Wk. Price Change: 2.4%; Yield: 0.4%

INVESTMENT THESIS: Marvell is a fabless supplier of high-performance standard and semi-custom infrastructure semiconductor solutions. These solutions power the data economy, enabling the data center, carrier infrastructure, enterprise networking, consumer, and automotive/industrial end markets. With roughly 75%-80% of Marvell’s revenue stream tied to digital infrastructure, we see it continuing to benefit from rising content consumption and creation. Pointing to that rising demand that necessitate network densification and the build of digital infrastructure, Ericsson sees global monthly average usage per smartphone reach 46 gigabytes (GB) by the end of 2028 vs. 19 GB in 2023 and 15 GB in 2022.

Target Price: Reiterate $62; Rating: Three

RISKS: Technology risk, customer risk, competition risk, reliance on manufacturing partners and supply chain constraints.

ACTIONS, ANALYSIS & MORE: We’re Watching These Three Names Set to Report Thursday, Why We Added This Chip Stock to the Bullpen, Investor Relations.

WEEKLY UPDATE: Microsoft reported quarterly results that bested Wall Street expectations, but as we discussed, the company laid out an aggressive spending plan to meet demand for its new artificial intelligence services. In the June quarter, its Azure and other cloud services posted revenue growth of 26% in the June quarter coming in at $24 billion, and revenue at its Productivity and Business Processes segment (Office 365, LinkedIn, Dynamics 365) came in at $18.3 billion, topping guidance for $17.9-18.2 billion. While Microsoft sees continued cloud and AI growth ahead, it also expects its capital spending to increase sequentially each quarter through the year as it scales to meet demand. That increased capital spend will drive costs higher, restraining margin improvement, potentially keeping the company’s operating margin flat on a year over year basis. Given Microsoft’s position in cloud and AI and those growth prospects, we will want to continue owning the shares even though the market is not pleased with the spending ramp. That realization pressured MSFT shares this week. We would look to re-think our Three rating on signs that spending is being curtailed and or evidence of greater-than-expected margin leverage is appearing.

1-Wk. Price Change: -1.6% Yield: 0.8%

INVESTMENT THESIS: We believe the cloud to be a secular growth trend and that upside to shares will result from Microsoft’s hybrid cloud leadership as the company grabs market share in this expanding industry. While companies may look to build out multi-cloud environments, Microsoft’s Azure offering will be a prime choice thanks to the company’s decision to provide the same “stack” used in the public cloud, to companies for their on-premises data centers. Additionally, we would note that hybrid environments are currently the preference for most companies because it allows them to maintain critical data in-house while taking advantage of the agility and scalability provided by public clouds. Outside of the cloud opportunity, we maintain a positive view on the company’s growing gaming business, which we believe is becoming an increasingly prominent factor in the Microsoft growth story as gaming becomes more mainstream, management works to convert its gaming revenue from one-time license purchase to a recurring subscription model and as technologies like augmented/virtual reality evolve. Finally, as it relates to LinkedIn and other subscription-based services such as O365 and various Dynamics products, we continue to value them highly for their recurring revenue streams, which we remind members, provide for greater transparency of future earnings.

Target Price: $390; Rating: Three.

RISKS: Slowdown in IT spending, competition, cannibalization of on-premises business by the cloud.

ACTIONS, ANALYSIS & MORE: FY4Q21 Earnings Analysis (7/27/21), Ignite 2021, Microsoft Acquires ZeniMax (9/22/20), CEO Satya Nadella on CNBC (3/25/20), CEO Satya Nadella speaks at the World Economic Forum (1/23/20)