Join the most important conversation in crypto and Web3 taking place in Austin, Texas, April 26-28.

Join the most important conversation in crypto and Web3 taking place in Austin, Texas, April 26-28.

For the past three years the Pew Research Center has polled Americans about their exposure to cryptocurrency. The percentage of people who have “ever invested in, traded or used a cryptocurrency such as bitcoin or ether” has remained roughly 16% since 2020. But this spring, Pew sought to identify how people feel about crypto. Among the 88% who have ever heard of cryptocurrency, 75% are “not very or not at all confident that cryptocurrencies are reliable or safe.” Only 6% are very confident.

Trust in crypto is very low.

The CoinDesk editorial team didn’t need a poll to see this. Our Most Influential 2022 list, published in December, subjectively identified the 50 people who defined the year in crypto. A significant percentage of the list was feel-bad stories of scammers and hucksters and possible sociopaths who depleted customer’s savings. The list came out less than a month after the sudden and shocking collapse of FTX, capping off a year of scandals. Understandably in response, Congress, mainstream media and the public are ready to punish crypto.

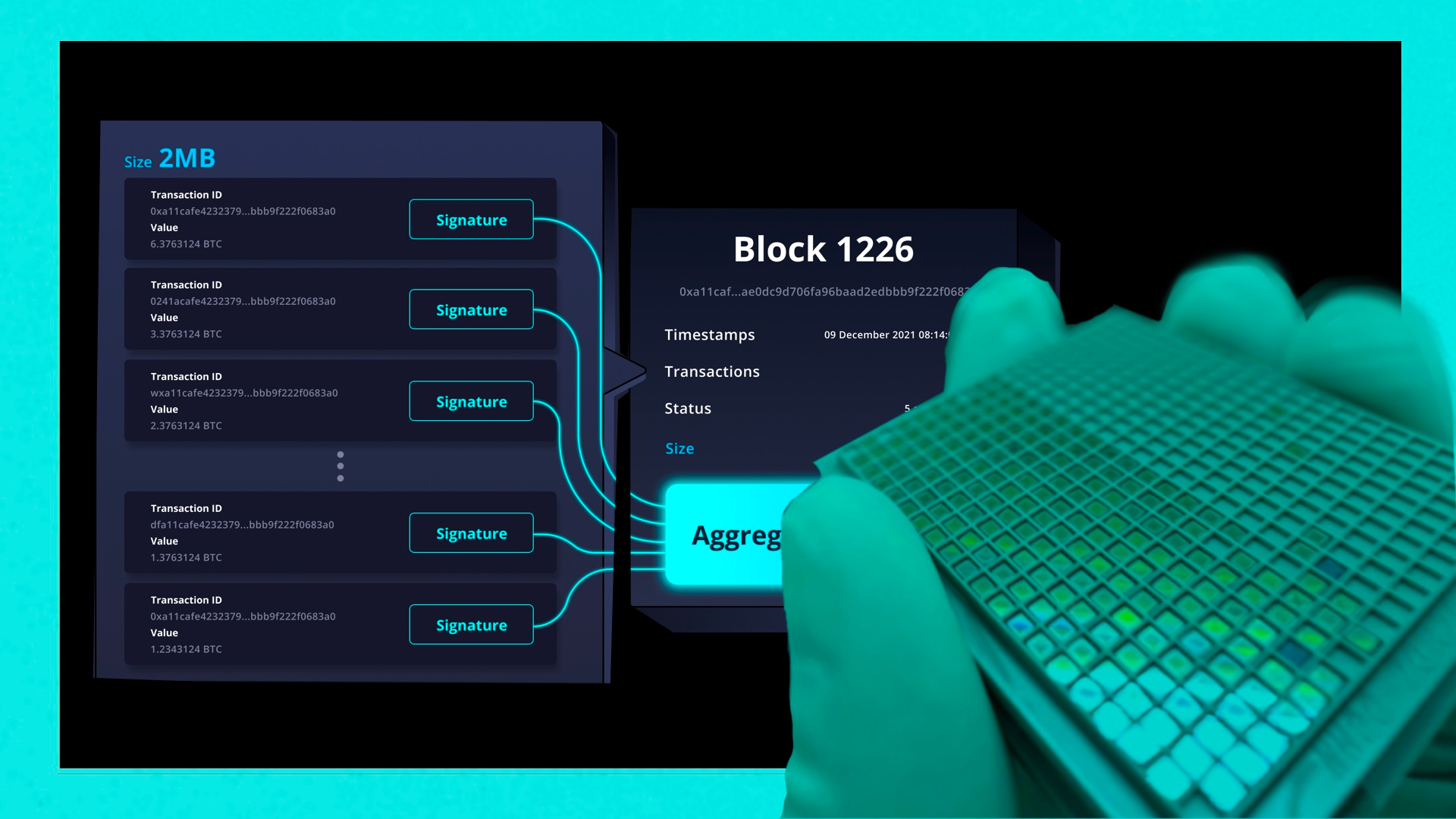

To state the obvious, 2022 was the antithesis of crypto, which was invented as a remedy in 2009 to broken global financial systems and not to make sharks and charlatans rich. Bitcoin made peer-to-peer transactions possible, bypassing banks that make the transfers slow, costly and intrusive. By solving the trusted-mediator problem, bitcoin allowed transactions to be quicker and cheaper and therefore more accessible.

The CoinDesk team set about to find projects that fulfill the ethos of crypto by solving a problem. In brainstorming sessions, we debated what problems crypto could be employed to solve, which quickly split into two baskets: problems within the crypto ecosystem itself, and problems in the world generally.

Then the team explored the merits of projects aiming to solve the identified problems. From a list of more than 35 projects, we selected 19. Some haven’t launched yet, others have been around for years. Funding ranges from bootstrapped to tens of millions of dollars, to undisclosed support from a parent foundation or project. We didn’t put a lot of restrictions or parameters on these projects. Crypto organizations come in many forms (from traditional startups to DAOs to major corporations). It is still relatively new and many of its brands – even if valued in the billions of dollars – are not widely recognized.

What the CoinDesk team looked for are innovative ideas, convincing proposals or evidence of success, and talented, committed people. Moreover, the problems the projects were aiming to solve had to be real, and the remedies needed. They could not just be a crypto version of something that is adequately managed in traditional finance, for instance, or purely meant for speculation or fun.

Below are CoinDesk’s Projects to Watch 2023, grouped by the broad problem they aim to solve.

The COVID-19 pandemic sped up adoption of digital services such as banking, and proved that they could be fast, flexible and reliable. But there are 1.4 billion adults – often rural, undereducated women – who are unbanked, according to the World Bank. Crypto can lower the barriers to access.

-

For proving bitcoin can sustain a community’s economy

-

For making it possible for Africans to buy and sell in crypto with basic mobile phones

-

For giving foreign workers a fast and cheap way to send their pay back home

This is the existential question of the entire crypto ecosystem. How do Web3, cryptocurrencies and blockchain gain mass adoption in order to thrive? By making themselves convenient, useful and easy to use.

-

For tapping trusted friends and family to maintain custody of crypto

-

For launching a single sign-on for gamers across multiple metaverses

-

For creating a foundation for the Open Metaverse

-

For making custody user-friendly and secure

Security is a widespread problem in crypto. Blockchains face huge existential threats, such as quantum computing, and individuals worry about verifying transactions and keeping wallets and accounts safe. Crypto has remedies for both ends of the spectrum.

-

For defending against the futuristic threat of Quantum computing

-

For using the promising account abstraction methods to secure transactions and accounts

While every transaction on a blockchain is public, the details are stubbornly not transparent, at least to most users. Understanding what’s happening on-chain can help identify illegal activity and provide market insights. Crypto can apply a magnifying glass to its own activity.

As blockchains become more useful, their transactions can sometimes get more energy-intensive, expensive and slower. Crypto can solve its own gridlock problems and invite wider adoption.

-

For helping developers store blockchain data, on and off chain

-

For taking the slow and precise approach to making Ethereum scalable and secure

Humans are sapping the Earth’s resources and releasing too much carbon into the atmosphere. Blockchain technology can be deployed to monitor actions and behavior as well as encourage sustainable alternatives.

-

For incentivizing ecologically-friendly behavior

-

For monitoring and reporting conditions on the ground and providing data

After disasters, people often respond generously by sending money to humanitarian organizations. But getting that cash to the people who need it is complicated. Crypto can speed up and simplify the process, and cheaply.

-

For giving people in crisis digital cash even if they don’t have internet access

-

For giving aid organizations an all-in-one system for digital cash aid

The developed world is grappling with advanced robots that can engage in natural conversation with humans while some poorly developed regions cannot maintain reliable electrical power. Crypto can plug remote communities in.

Crypto Twitter is the unofficial public square for crypto enthusiasts of every flavor. But now, following Elon Musk’s acquisition, the social media platform has become privatized and policed erratically, turning off not just Crypto Twitter but the wider world. The crypto community is offering decentralized alternatives.

DISCLOSURE

Please note that our privacy policy, terms of use, cookies, and do not sell my personal information has been updated.

The leader in news and information on cryptocurrency, digital assets and the future of money, CoinDesk is a media outlet that strives for the highest journalistic standards and abides by a strict set of editorial policies. CoinDesk is an independent operating subsidiary of Digital Currency Group, which invests in cryptocurrencies and blockchain startups. As part of their compensation, certain CoinDesk employees, including editorial employees, may receive exposure to DCG equity in the form of stock appreciation rights, which vest over a multi-year period. CoinDesk journalists are not allowed to purchase stock outright in DCG.

Learn more about Consensus 2023, CoinDesk’s longest-running and most influential event that brings together all sides of crypto, blockchain and Web3. Head to consensus.coindesk.com to register and buy your pass now.

Post Disclaimer

The information provided in our posts or blogs are for educational and informative purposes only. We do not guarantee the accuracy, completeness or suitability of the information. We do not provide financial or investment advice. Readers should always seek professional advice before making any financial or investment decisions based on the information provided in our content. We will not be held responsible for any losses, damages or consequences that may arise from relying on the information provided in our content.

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/SGXZZU6C55AR5CDWXTKWBCQJRY.png)

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/4HD7OZFVNRG2BCYHVAQE4VEF4Y.jpg)

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/E2DGZAUMYRCJRMSAYNPPURQKOY.jpg)

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/QYS6MN2SVBBJ5AXQBXJ35S6V4E.jpg)

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/VVXTSAVHIBFZDOT2H4TJBNRLZY.png)

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/EA2UGDOYNVCYHKFROKYZFROLPM.jpg)

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/DUGLO2I72ZE4LDVVS7YG25FBWY.jpg)

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/XSGROYJHJZARZL2MBDM3K4YPD4.jpg)